Page 74 - M97TB9_2018-19_[low-res]_F2F_Neat2

P. 74

4/2 M97/February 2018 Reinsurance

Introduction

Non-proportional A reinsurance treaty is a method of reinsurance whereby the insurer and reinsurer enter into an

treaties will be

examined in agreement for the former to cede and the latter to accept all insurances offered within the limits of the

chapter 5 treaty. This means that automatic acceptance is secured and there is an obligation for the reinsurer to

accept all risks within the scope of the treaty. The insurer can, therefore, grant cover immediately for any

proposal accepted within the limits of the treaty. In this chapter we look at the characteristics of

proportional treaties and the ways in which they operate.

Key terms

This chapter features explanations of the following terms and concepts:

Capacity Cession limit Claims reserve Clean cut accounting

Commission Event limit Exposure Facultative carve-out

Loss participation Net retention Portfolio transfer Premium reserve

4 Proportional reinsurance Quota share treaty Sliding scale Surplus treaty

Chapter treaty

Underwriting year

accounting

A Main features and operation of proportional

reinsurance treaties

There are two main types of proportional reinsurance treaty. The first results in sharing all risks between

Two main types of

proportional the insurer and the reinsurers and is known as a quota share treaty. The second enables the insurer to

reinsurance treaty retain the smaller risks while sharing proportionately the larger risks and is known as a surplus treaty.

We will also make some reference to facultative obligatory treaties in this chapter. Reference copy for CII Face to Face Training

Reinforce

Make sure you are clear on this key difference between a quota share treaty and a surplus treaty.

A1 Quota share treaties

A quota share is an obligatory treaty where the insurer has to cede a fixed percentage of all its risks

within agreed parameters. The reinsurer is then obliged to accept all the cessions made, usually subject

to a maximum amount in any one cession.

A1A Operation of quota share treaties

Let us start by looking at an example.

Example 4.1

The insurer retains 40% of all business written for its own account under its taxicab account. The insurer reinsures

with the reinsurer, who agrees to accept a 60% share of all business written under the insurer’s taxicab account. The

reinsurer agrees that the insurer should have the benefit of a 12% ceding commission to cover the costs of acquiring

and managing the original business.

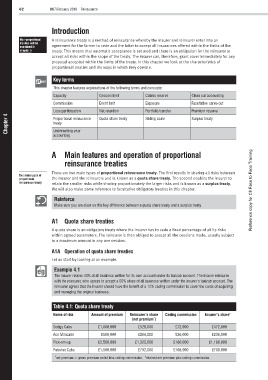

Table 4.1: Quota share treaty

Name of risk Amount of premium Reinsurer’s share Ceding commission Insurer’s share †

*

(net premium )

Dodgy Cabs £1,000,000 £528,000 £72,000 £472,000

Ace Minicabs £500,000 £264,000 £36,000 £236,000

Pick-em-up £2,500,000 £1,320,000 £180,000 £1,180,000

Pubshut Cabs £1,500,000 £792,000 £108,000 £708,000

†

* net premium = gross premium ceded less ceding commission. retained net premium plus ceding commission.