Page 75 - M97TB9_2018-19_[low-res]_F2F_Neat2

P. 75

Chapter 4 Features and operation of proportional reinsurance treaties 4/3

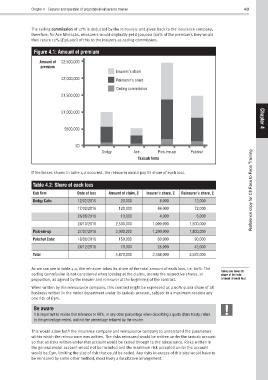

The ceding commission of 12% is deducted by the reinsurers and given back to the insurance company,

therefore, for Ace Minicabs, reinsurers would originally get £300,000 (60% of the premium), they would

then return 12% (£36,000) of this to the insurers as ceding commission.

Figure 4.1: Amount of premium

Amount of £2,500,000

premium

Insurers’s share

£2,000,000 Reinsurer’s share

Ceding commission

£1,500,000

£1,000,000 Chapter

£500,000 4

£0

Dodgy Ace Pick-em-up Pubshut

Taxicab firms

If the losses shown in table 4.2 occurred, the reinsurer would pay its share of each loss.

Table 4.2: Share of each loss

Cab firm Date of loss Amount of claim, £ Insurer’s share, £ Reinsurer’s share, £ Reference copy for CII Face to Face Training

Dodgy Cabs 12/02/2016 20,000 8,000 12,000

17/02/2016 120,000 48,000 72,000

26/06/2016 10,000 4,000 6,000

24/10/2016 2,500,000 1,000,000 1,500,000

Pick-em-up 27/07/2016 3,000,000 1,200,000 1,800,000

Pubshut Cabs 18/06/2016 150,000 60,000 90,000

24/12/2016 70,000 28,000 42,000

Total 5,870,000 2,348,000 3,522,000

As we can see in table 4.2, the reinsurer takes its share of the total amount of each loss, i.e. 60%. The

Reinsurer takes its

ceding commission is not considered when looking at the claims, merely the respective shares, or share of the total

proportion, as agreed by the insurer and reinsurer at the beginning of the contract. amount of each loss

When written by the reinsurance company, this contract might be expressed as a 60% quota share of all

business written in the motor department under its taxicab account, subject to a maximum cession any

one risk of £3m.

Be aware

It is important to realise that reference to 60%, or any other percentage when describing a quota share treaty, refers

to the percentage ceded, and not the percentage retained by the insurer.

This would allow both the insurance company and reinsurance company to understand the parameters

within which the reinsurance was written. The risks reinsured would be written under the taxicab account

so that all risks written under that account would be ceded through to the reinsurance. Risks written in

the general motor account would not be included and the maximum risk accepted under the account

would be £3m, limiting the size of risk that could be ceded. Any risks in excess of this size would have to

be reinsured by some other method, most likely a facultative arrangement.