Page 79 - M97TB9_2018-19_[low-res]_F2F_Neat2

P. 79

Chapter 4 Features and operation of proportional reinsurance treaties 4/7

Surplus treaties are usually a specified multiple of that gross retention, resulting in surplus capacity

being described as ‘x lines of y maximum gross retention’. For example, a ten-line first surplus treaty

subject to a maximum cession of £5m on any one risk. One line is a maximum of £500,000, thereby

giving the insurer a maximum gross capacity of £5.5m on the best risks (i.e. retention £0.5m plus

cession to surplus of £5m).

There are also cases where surplus capacity is constructed on the insurer’s net retention, or gross

retention after quota share cession, but we shall concentrate on surplus capacity geared to a gross

retention. If the reinsurance treaty were a ten-line surplus treaty, the maximum coverage under the

reinsurance would be as follows:

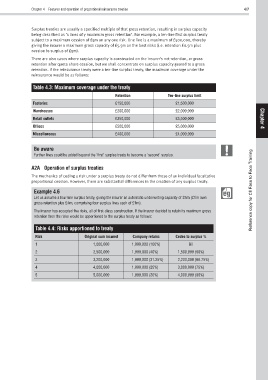

Table 4.3: Maximum coverage under the treaty

Retention Ten-line surplus limit

Factories £150,000 £1,500,000

Warehouses £200,000 £2,000,000

Retail outlets £350,000 £3,500,000 Chapter

Offices £500,000 £5,000,000 4

Miscellaneous £400,000 £4,000,000

Be aware

Further lines could be added beyond the ‘first’ surplus treaty to become a ‘second’ surplus.

A2A Operation of surplus treaties

The mechanics of ceding a risk under a surplus treaty do not differ from those of an individual facultative

proportional cession. However, there are substantial differences in the creation of any surplus treaty.

Example 4.6 Reference copy for CII Face to Face Training

Let us assume a four-line surplus treaty, giving the insurer an automatic underwriting capacity of £5m (£1m own

gross retention plus £4m, comprising four surplus lines each of £1m).

The insurer has accepted five risks, all of first-class construction. If the insurer decided to retain its maximum gross

retention then the risks would be apportioned to the surplus treaty as follows:

Table 4.4: Risks apportioned to treaty

Risk Original sum insured Company retains Cedes to surplus %

1 1,000,000 1,000,000 (100%) Nil

2 2,500,000 1,000,000 (40%) 1,500,000 (60%)

3 3,200,000 1,000,000 (31.25%) 2,200,000 (68.75%)

4 4,000,000 1,000,000 (25%) 3,000,000 (75%)

5 5,000,000 1,000,000 (20%) 4,000,000 (80%)