Page 83 - M97TB9_2018-19_[low-res]_F2F_Neat2

P. 83

Chapter 4 Features and operation of proportional reinsurance treaties 4/11

However, surplus treaties are significantly more complicated to administer than quota share treaties

because the proportion ceded varies from risk to risk. Additionally, there is always the possibility that

they will attract a higher than usual proportion of the larger or more hazardous risks. This makes them

difficult to arrange if the balance between the premium income available and the maximum liability to be

assumed is not adequate or reasonable.

In obligatory surplus treaties the insurer, having exhausted its retention, is obliged to feed the different

covers successively. Nevertheless, the insurer retains the right to proceed selectively by the terms of the

treaty wording in order to protect the treaties. For example, in the case of particularly large risks, the

insurer would only use a part of its surplus capacity or would reinsure all of the risk facultatively.

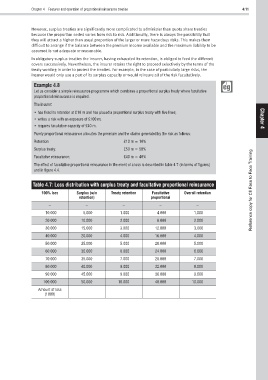

Example 4.8

Let us consider a simple reinsurance programme which combines a proportional surplus treaty where facultative

proportional reinsurance is required.

The insurer:

• has fixed its retention at £10 m and has placed a proportional surplus treaty with five lines;

• writes a risk with an exposure of £100 m; Chapter

• requires facultative capacity of £40 m. 4

Purely proportional reinsurance allocates the premium and the claims generated by the risk as follows:

Retention: £10 m = 10%

Surplus treaty: £50 m = 50%

Facultative reinsurance: £40 m = 40%

The effect of facultative proportional reinsurance in the event of a loss is described in table 4.7 (in terms of figures)

and in figure 4.4.

Table 4.7: Loss distribution with surplus treaty and facultative proportional reinsurance

100% loss Surplus (w/o Treaty retention Facultative Overall retention Reference copy for CII Face to Face Training

retention) proportional

– – – – –

10.000 5.000 1.000 4.000 1.000

20.000 10.000 2.000 8.000 2.000

30.000 15.000 3.000 12.000 3.000

40.000 20.000 4.000 16.000 4.000

50.000 25.000 5.000 20.000 5.000

60.000 30.000 6.000 24.000 6.000

70.000 35.000 7.000 28.000 7.000

80.000 40.000 8.000 32.000 8.000

90.000 45.000 9.000 36.000 9.000

100.000 50.000 10.000 40.000 10.000

Amount of loss

(1000)