Page 84 - M97TB9_2018-19_[low-res]_F2F_Neat2

P. 84

4/12 M97/February 2018 Reinsurance

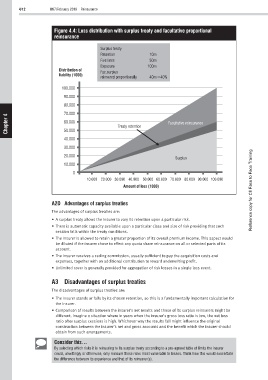

Figure 4.4: Loss distribution with surplus treaty and facultative proportional

reinsurance

Surplus treaty

Retention 10m

Five lines 50m

Exposure 100m

Distribution of Fac.surplus

liability (1000)

reinsured proportionally 40m =40%

100.000

90.000

80.000

70.000

4

Chapter 60.000 Treaty retention Facultative reinsurance

50.000

40.000

30.000

20.000

Surplus

10.000

0

10.000 20.000 30.000 40.000 50.000 60.000 70.000 80.000 90.000 100.000

Amount of loss (1000) Reference copy for CII Face to Face Training

A2D Advantages of surplus treaties

The advantages of surplus treaties are:

• A surplus treaty allows the insurer to vary its retention upon a particular risk.

• There is automatic capacity available upon a particular class and size of risk providing that such

cession falls within the treaty conditions.

• The insurer is allowed to retain a greater proportion of its overall premium income. This aspect would

be diluted if the insurer chose to effect any quota share reinsurance on all or selected parts of its

account.

• The insurer receives a ceding commission, usually sufficient to pay the acquisition costs and

expenses, together with an additional contribution to reward underwriting profit.

• Unlimited cover is generally provided for aggregation of risk losses in a single loss event.

A3 Disadvantages of surplus treaties

The disadvantages of surplus treaties are:

• The insurer stands or falls by its chosen retention, so this is a fundamentally important calculation for

the insurer.

• Comparison of results between the insurer’s net results and those of its surplus reinsurers might be

different. Imagine a situation where in years when the insurer’s gross loss ratio is low, the net loss

ratio after surplus cessions is high. Whichever way the results fall might influence the original

construction between the insurer’s net and gross accounts and the benefit which the insurer should

obtain from such arrangements.

Consider this…

By selecting which risks it is reinsuring to its surplus treaty according to a pre-agreed table of limits the insurer

could, unwittingly or otherwise, only reinsure those risks most vulnerable to losses. Think how this would exacerbate

the difference between its experience and that of its reinsurer(s).