Page 81 - M97TB9_2018-19_[low-res]_F2F_Neat2

P. 81

Chapter 4 Features and operation of proportional reinsurance treaties 4/9

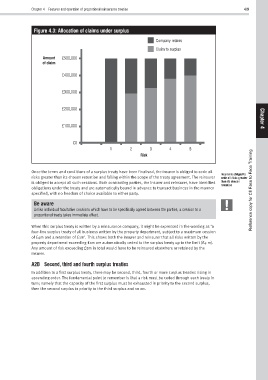

Figure 4.3: Allocation of claims under surplus

Company retains

Claim to surplus

Amount £500,000

of claim

£400,000

£300,000

£200,000 Chapter

£100,000 4

£0

1 2 3 4 5

Risk

Once the terms and conditions of a surplus treaty have been finalised, the insurer is obliged to cede all

Insurer is obliged to

risks greater than its chosen retention and falling within the scope of the treaty agreement. The reinsurer cede all risks greater

is obliged to accept all such cessions. Both contracting parties, the insurer and reinsurer, have identified than its chosen

retention

obligations under the treaty and are automatically bound in advance to transact business in the manner Reference copy for CII Face to Face Training

specified, with no freedom of choice available to either party.

Be aware

Unlike individual facultative cessions which have to be specifically agreed between the parties, a cession to a

proportional treaty takes immediate effect.

When this surplus treaty is written by a reinsurance company, it might be expressed in the wording as ‘a

four-line surplus treaty of all business written by the property department, subject to a maximum cession

of £4m and a retention of £1m’. This shows both the insurer and reinsurer that all risks written by the

property department exceeding £1m are automatically ceded to the surplus treaty up to the limit (£4 m).

Any amount of risk exceeding £5m in total would have to be reinsured elsewhere or retained by the

insurer.

A2B Second, third and fourth surplus treaties

In addition to a first surplus treaty, there may be second, third, fourth or more surplus treaties rising in

ascending order. The fundamental point to remember is that a risk must be ceded through each treaty in

turn; namely that the capacity of the first surplus must be exhausted in priority to the second surplus,

then the second surplus in priority to the third surplus and so on.