Page 82 - M97TB9_2018-19_[low-res]_F2F_Neat2

P. 82

4/10 M97/February 2018 Reinsurance

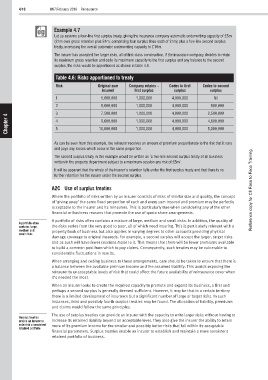

Example 4.7

Let us assume a four-line first surplus treaty, giving the insurance company automatic underwriting capacity of £5m

(£1m own gross retention plus £4m, comprising four surplus lines each of £1m) plus a five-line second surplus

treaty, increasing the overall automatic underwriting capacity to £10m.

The insurer has accepted five larger risks, all of first-class construction. If the insurance company decides to retain

its maximum gross retention and cede its maximum capacity to the first surplus and any balance to the second

surplus, the risks would be apportioned as shown in table 4.6.

Table 4.6: Risks apportioned to treaty

Risk Original sum Company retains – Cedes to first Cedes to second

insured first surplus surplus surplus

1 5,000,000 1,000,000 4,000,000 Nil

2 5,500,000 1,000,000 4,000,000 500,000

3 7,500,000 1,000,000 4,000,000 2,500,000

4

Chapter 4 5 10,000,000 1,000,000 4,000,000 4,600,000

9,600,000

5,000,000

1,000,000

4,000,000

As can be seen from this example, the reinsurer receives an amount of premium proportionate to the risk that it runs

and pays any losses which occur in the same proportion.

The second surplus treaty in this example would be written as ‘a five-line second surplus treaty of all business

written in the property department subject to a maximum cession any risk of £5m’.

It will be apparent that the whole of the insurer’s retention falls under the first surplus treaty and that there is no

further retention for the insurer under the second surplus.

A2C Use of surplus treaties Reference copy for CII Face to Face Training

Where the portfolio of risks written by an insurer consists of risks of similar size and quality, the concept

of ‘giving away’ the same fixed proportion of each and every sum insured and premium may be perfectly

acceptable to the insurer and its reinsurers. This is particularly true when considering any of the other

financial or business reasons that promote the use of quota share arrangements.

A portfolio of risks often contains a mixture of large, medium and small risks. In addition, the quality of

A portfolio often

contains large, the risks varies from the very good to poor, all of which need insuring. This is particularly relevant with a

medium and property book of business but also applies in varying degrees to other accounts providing physical

small risks

damage coverage to original insureds. For example, a second surplus will accept the larger, target risks

and as such will have fewer cessions made to it. This means that there will be fewer premiums available

to build a common pool from which to pay claims. Consequently, such treaties may be vulnerable to

considerable fluctuations in results.

When arranging and ceding business to these arrangements, care should be taken to ensure that there is

a balance between the available premium income and the assumed liability. This avoids exposing the

reinsurer to unacceptable levels of risk that could affect the future availability of reinsurance cover when

it’s needed the most.

When an insurer looks to create the required capacity to promote and expand its business, a first and

perhaps a second surplus is generally deemed sufficient. However, it may be that in a certain territory

there is a limited development of insurance but a significant number of large or target risks. In such

instances, third and possibly fourth surplus treaties may be found. The allocation of liability, premiums

and claims would follow the same principles.

The use of surplus treaties can provide an insurer with the capacity to write larger risks without having to

Surplus treaties

enable an insurer to increase its retained liability beyond an acceptable level. They also give the insurer the ability to retain

establish a consistent more of its premium income for the smaller and possibly better risks that fall within its acceptable

retained portfolio

financial parameters. Surplus treaties enable an insurer to establish and maintain a more consistent

retained portfolio of business.