Page 3 - ITC Service Group 2022 Benefit Guide

P. 3

MEDICAL AND PHARMACY COVERAGE

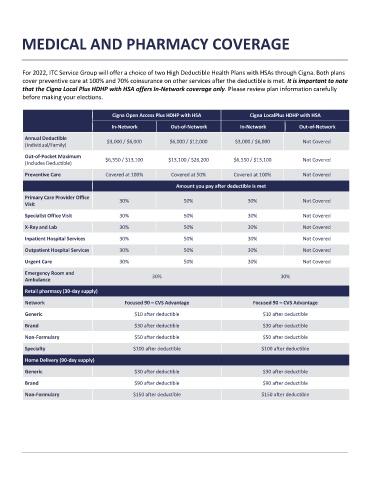

For 2022, ITC Service Group will offer a choice of two High Deductible Health Plans with HSAs through Cigna. Both plans

cover preventive care at 100% and 70% coinsurance on other services after the deductible is met. It is important to note

that the Cigna Local Plus HDHP with HSA offers In-Network coverage only. Please review plan information carefully

before making your elections.

Cigna Open Access Plus HDHP with HSA Cigna LocalPlus HDHP with HSA

In-Network Out-of-Network In-Network Out-of-Network

Annual Deductible

(Individual/Family) $3,000 / $6,000 $6,000 / $12,000 $3,000 / $6,000 Not Covered

Out-of-Pocket Maximum $6,550 / $13,100 $13,100 / $26,200 $6,550 / $13,100 Not Covered

(Includes Deductible)

Preventive Care Covered at 100% Covered at 50% Covered at 100% Not Covered

Amount you pay after deductible is met

Primary Care Provider Office 30% 50% 30% Not Covered

Visit

Specialist Office Visit 30% 50% 30% Not Covered

X-Ray and Lab 30% 50% 30% Not Covered

Inpatient Hospital Services 30% 50% 30% Not Covered

Outpatient Hospital Services 30% 50% 30% Not Covered

Urgent Care 30% 50% 30% Not Covered

Emergency Room and

Ambulance 30% 30%

Retail pharmacy (30-day supply)

Network Focused 90 – CVS Advantage Focused 90 – CVS Advantage

Generic $10 after deductible $10 after deductible

Brand $30 after deductible $30 after deductible

Non-Formulary $50 after deductible $50 after deductible

Specialty $100 after deductible $100 after deductible

Home Delivery (90-day supply)

Generic $30 after deductible $30 after deductible

Brand $90 after deductible $90 after deductible

Non-Formulary $150 after deductible $150 after deductible