Page 5 - ECRM 2022 Benefits Guide (CA)

P. 5

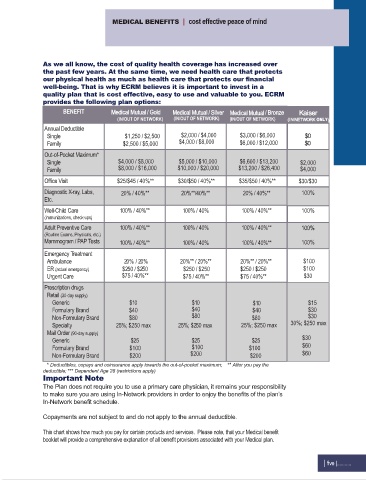

MEDICAL BENEFITS | cost effective peace of mind

As we all know, the cost of quality health coverage has increased over

the past few years. At the same time, we need health care that protects

our physical health as much as health care that protects our financial

well-being. That is why ECRM believes it is important to invest in a

quality plan that is cost effective, easy to use and valuable to you. ECRM

provides the following plan options:

BENEFIT Medical Mutual / Gold Medical Mutual / Silver Medical Mutual / Bronze Kaiser

(IN/OUT OF NETWORK) (IN/OUT OF NETWORK) (IN/OUT OF NETWORK) (IN NETWORK ONLY )

Annual Deductible

Single $1,250 / $2,500 $2,000 / $4,000 $3,000 / $6,000 $0

Family $2,500 / $5,000 $4,000 / $8,000 $6,000 / $12,000 $0

Out-of-Pocket Maximum*

Single $4,000 / $8,000 $5,000 / $10,000 $6,600 / $13,200 $2,000

Family $8,000 / $16,000 $10,000 / $20,000 $13,200 / $26,400 $4,000

Office Visit $25/$45 / 40%** $30/$50 / 40%** $35/$50 / 40%** $30/$30

Diagnostic X-ray, Labs, 20% / 40%** 20%**/40%** 20% / 40%** 100%

Etc.

Well-Child Care 100% / 40%** 100% / 40% 100% / 40%** 100%

(immunizations, check-ups)

Adult Preventive Care 100% / 40%** 100% / 40% 100% / 40%** 100%

(Routine Exams, Physicals, etc.)

Mammogram / PAP Tests 100% / 40%** 100% / 40% 100% / 40%** 100%

Emergency Treatment

Ambulance 20% / 20% 20%** / 20%** 20%** / 20%** $100

ER (actual emergency) $250 / $250 $250 / $250 $250 / $250 $100

Urgent Care $75 / 40%** $75 / 40%** $75 / 40%** $30

Prescription drugs

Retail (30-day supply)

Generic $10 $10 $10 $15

Formulary Brand $40 $40 $40 $30

Non-Formulary Brand $80 $80 $80 $30

Specialty 25%; $250 max 25%; $250 max 25%; $250 max 30%; $250 max

Mail Order (90-day supply)

Generic $25 $25 $25 $30

Formulary Brand $100 $100 $100 $60

Non-Formulary Brand $200 $200 $200 $60

* Deductibles, copays and coinsurance apply towards the out-of-pocket maximum; ** After you pay the

deductible; *** Dependent Age 28 (restrictions apply)

Important Note

The Plan does not require you to use a primary care physician, it remains your responsibility

to make sure you are using In-Network providers in order to enjoy the benefits of the plan’s

In-Network benefit schedule.

Copayments are not subject to and do not apply to the annual deductible.

This chart shows how much you pay for certain products and services. Please note, that your Medical benefit

booklet will provide a comprehensive explanation of all benefit provisions associated with your Medical plan.

| five |...........