Page 4 - 2022 New Relic Guide

P. 4

Summary of Your Your Health Pre-Tax Spending Life/AD&D Where to Find

Summary of Your

How to Get Started Dental & Vision 401(k) Additional Benefits

Contributions

Contributions Benefits Accounts Disability Support

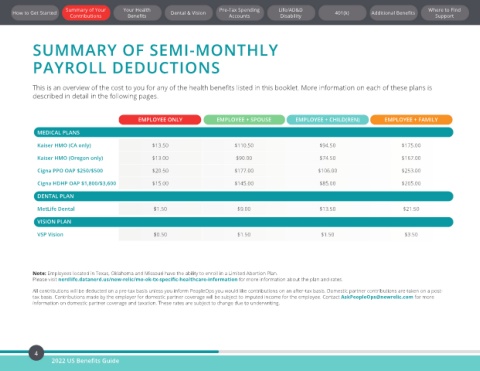

SUMMARY OF SEMI-MONTHLY

PAYROLL DEDUCTIONS

This is an overview of the cost to you for any of the health benefits listed in this booklet. More information on each of these plans is

described in detail in the following pages.

EMPLOYEE ONLY EMPLOYEE + SPOUSE EMPLOYEE + CHILD(REN) EMPLOYEE + FAMILY

MEDICAL PLANS

Kaiser HMO (CA only) $13.50 $110.50 $94.50 $175.00

Kaiser HMO (Oregon only) $13.00 $90.00 $74.50 $167.00

Cigna PPO OAP $250/$500 $20.50 $177.00 $106.00 $253.00

Cigna HDHP OAP $1,800/$3,600 $15.00 $145.00 $85.00 $205.00

DENTAL PLAN

MetLife Dental $1.50 $9.00 $13.50 $21.50

VISION PLAN

VSP Vision $0.50 $1.50 $1.50 $3.50

Note: Employees located in Texas, Oklahoma and Missouri have the ability to enroll in a Limited Abortion Plan.

Please visit nerdlife.datanerd.us/new-relic/mo-ok-tx-specific-healthcare-information for more information about the plan and rates.

All contributions will be deducted on a pre-tax basis unless you inform PeopleOps you would like contributions on an after-tax basis. Domestic partner contributions are taken on a post-

tax basis. Contributions made by the employer for domestic partner coverage will be subject to imputed income for the employee. Contact AskPeopleOps@newrelic.com for more

information on domestic partner coverage and taxation. These rates are subject to change due to underwriting.

4

2022 US Benefits Guide