Page 11 - Mersen Benefit Guide Local 502

P. 11

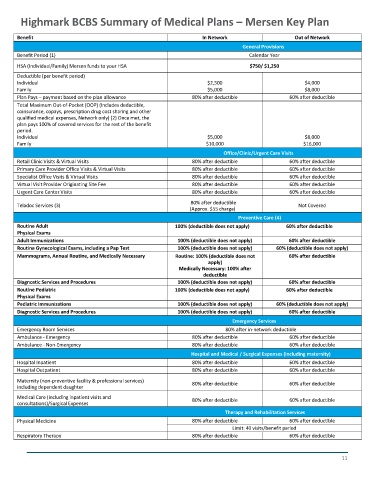

Highmark BCBS Summary of Medical Plans – Mersen Key Plan

Benefit In Network Out of Network

General Provisions

Benefit Period (1) Calendar Year

HSA (Individual/Family) Mersen funds to your HSA $750/ $1,250

Deductible (per benefit period)

Individual $2,500 $4,000

Family $5,000 $8,000

Plan Pays – payment based on the plan allowance 80% after deductible 60% after deductible

Total Maximum Out-of-Pocket (OOP) (Includes deductible,

coinsurance, copays, prescription drug cost sharing and other

qualified medical expenses, Network only) (2) Once met, the

plan pays 100% of covered services for the rest of the benefit

period.

Individual $5,000 $8,000

Family $10,000 $16,000

Office/Clinic/Urgent Care Visits

Retail Clinic Visits & Virtual Visits 80% after deductible 60% after deductible

Primary Care Provider Office Visits & Virtual Visits 80% after deductible 60% after deductible

Specialist Office Visits & Virtual Visits 80% after deductible 60% after deductible

Virtual Visit Provider Originating Site Fee 80% after deductible 60% after deductible

Urgent Care Center Visits 80% after deductible 60% after deductible

80% after deductible

Teladoc Services (3) Not Covered

(Approx. $55 charge)

Preventive Care (4)

Routine Adult 100% (deductible does not apply) 60% after deductible

Physical Exams

Adult Immunizations 100% (deductible does not apply) 60% after deductible

Routine Gynecological Exams, including a Pap Test 100% (deductible does not apply) 60% (deductible does not apply)

Mammograms, Annual Routine, and Medically Necessary Routine: 100% (deductible does not 60% after deductible

apply)

Medically Necessary: 100% after

deductible

Diagnostic Services and Procedures 100% (deductible does not apply) 60% after deductible

Routine Pediatric 100% (deductible does not apply) 60% after deductible

Physical Exams

Pediatric Immunizations 100% (deductible does not apply) 60% (deductible does not apply)

Diagnostic Services and Procedures 100% (deductible does not apply) 60% after deductible

Emergency Services

Emergency Room Services 80% after in-network deductible

Ambulance - Emergency 80% after deductible 60% after deductible

Ambulance - Non-Emergency 80% after deductible 60% after deductible

Hospital and Medical / Surgical Expenses (including maternity)

Hospital Inpatient 80% after deductible 60% after deductible

Hospital Outpatient 80% after deductible 60% after deductible

Maternity (non-preventive facility & professional services) 80% after deductible 60% after deductible

including dependent daughter

Medical Care (including inpatient visits and 80% after deductible 60% after deductible

consultations)/Surgical Expenses

Therapy and Rehabilitation Services

Physical Medicine 80% after deductible 60% after deductible

Limit: 40 visits/benefit period

Respiratory Therapy 80% after deductible 60% after deductible

11