Page 7 - Mersen Benefit Guide Local 502

P. 7

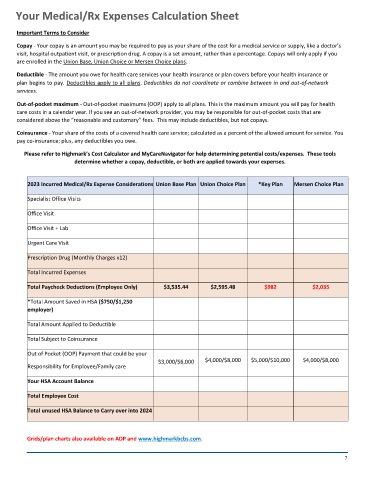

Your Medical/Rx Expenses Calculation Sheet

Important Terms to Consider

Copay - Your copay is an amount you may be required to pay as your share of the cost for a medical service or supply, like a doctor’s

visit, hospital outpatient visit, or prescription drug. A copay is a set amount, rather than a percentage. Copays will only apply if you

are enrolled in the Union Base, Union Choice or Mersen Choice plans.

Deductible - The amount you owe for health care services your health insurance or plan covers before your health insurance or

plan begins to pay. Deductibles apply to all plans. Deductibles do not coordinate or combine between in and out-of-network

services.

Out-of-pocket maximum - Out-of-pocket maximums (OOP) apply to all plans. This is the maximum amount you will pay for health

care costs in a calendar year. If you see an out-of-network provider, you may be responsible for out-of-pocket costs that are

considered above the “reasonable and customary” fees. This may include deductibles, but not copays.

Coinsurance - Your share of the costs of a covered health care service; calculated as a percent of the allowed amount for service. You

pay co-insurance; plus, any deductibles you owe.

Please refer to Highmark’s Cost Calculator and MyCareNavigator for help determining potential costs/expenses. These tools

determine whether a copay, deductible, or both are applied towards your expenses.

2023 Incurred Medical/Rx Expense Considerations Union Base Plan Union Choice Plan *Key Plan Mersen Choice Plan

Specialist Office Visits

Office Visit

Office Visit + Lab

Urgent Care Visit

Prescription Drug (Monthly Charges x12)

Total Incurred Expenses

Total Paycheck Deductions (Employee Only) $3,535.44 $2,595.48 $982 $2,035

*Total Amount Saved in HSA ($750/$1,250

employer)

Total Amount Applied to Deductible

Total Subject to Coinsurance

Out of Pocket (OOP) Payment that could be your

$3,000/$6,000 $4,000/$8,000 $5,000/$10,000 $4,000/$8,000

Responsibility for Employee/Family care

Your HSA Account Balance

Total Employee Cost

Total unused HSA Balance to Carry over into 2024

Grids/plan charts also available on ADP and www.highmarkbcbs.com.

7