Page 5 - 2023 HCTec Benefits Guide Consultant

P. 5

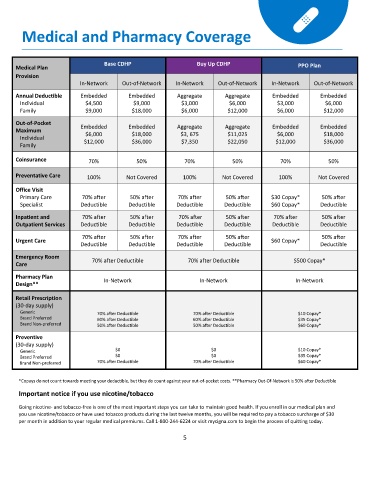

Medical and Pharmacy Coverage

Base CDHP Buy Up CDHP

Medical Plan PPO Plan

Provision

In-Network Out-of-Network In-Network Out-of-Network In-Network Out-of-Network

Annual Deductible Embedded Embedded Aggregate Aggregate Embedded Embedded

Individual $4,500 $9,000 $3,000 $6,000 $3,000 $6,000

Family $9,000 $18,000 $6,000 $12,000 $6,000 $12,000

Out-of-Pocket

Embedded Embedded Aggregate Aggregate Embedded Embedded

Maximum $6,000 $18,000 $3, 675 $11,025 $6,000 $18,000

Individual $12,000 $36,000 $7,350 $22,050 $12,000 $36,000

Family

Coinsurance 70% 50% 70% 50% 70% 50%

Preventative Care 100% Not Covered 100% Not Covered 100% Not Covered

Office Visit

Primary Care 70% after 50% after 70% after 50% after $30 Copay* 50% after

Specialist Deductible Deductible Deductible Deductible $60 Copay* Deductible

Inpatient and 70% after 50% after 70% after 50% after 70% after 50% after

Outpatient Services Deductible Deductible Deductible Deductible Deductible Deductible

70% after 50% after 70% after 50% after 50% after

Urgent Care $60 Copay*

Deductible Deductible Deductible Deductible Deductible

Emergency Room

70% after Deductible 70% after Deductible $500 Copay*

Care

Pharmacy Plan In-Network In-Network In-Network

Design**

Retail Prescription

(30-day supply)

Generic 70% after Deductible 70% after Deductible $10 Copay*

Brand Preferred 60% after Deductible 60% after Deductible $35 Copay*

Brand Non-preferred 50% after Deductible 50% after Deductible $60 Copay*

Preventive

(30-day supply)

Generic $0 $0 $10 Copay*

Brand Preferred $0 $0 $35 Copay*

Brand Non-preferred 70% after Deductible 70% after Deductible $60 Copay*

*Copays do not count towards meeting your deductible, but they do count against your out-of-pocket costs. **Pharmacy Out-Of-Network is 50% after Deductible

Important notice if you use nicotine/tobacco

Going nicotine- and tobacco-free is one of the most important steps you can take to maintain good health. If you enroll in our medical plan and

you use nicotine/tobacco or have used tobacco products during the last twelve months, you will be required to pay a tobacco surcharge of $30

per month in addition to your regular medical premiums. Call 1-800-244-6224 or visit mycigna.com to begin the process of quitting today.

5