Page 12 - Fort Health Care 2022 Benefit Guide

P. 12

P a g e | 12

HEALTH CARE EXPENSES

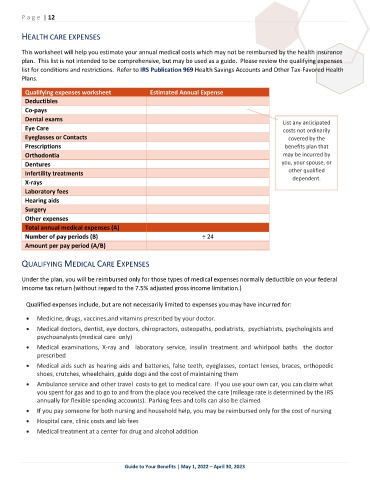

This worksheet will help you estimate your annual medical costs which may not be reimbursed by the health insurance

plan. This list is not intended to be comprehensive, but may be used as a guide. Please review the qualifying expenses

list for conditions and restrictions. Refer to IRS Publication 969 Health Savings Accounts and Other Tax-Favored Health

Plans.

Qualifying expenses worksheet Estimated Annual Expense

Deductibles

Co-pays

Dental exams

List any anticipated

Eye Care costs not ordinarily

Eyeglasses or Contacts covered by the

Prescriptions benefits plan that

Orthodontia may be incurred by

Dentures you, your spouse, or

other qualified

Infertility treatments

dependent.

X-rays

Laboratory fees

Hearing aids

Surgery

Other expenses

Total annual medical expenses (A)

Number of pay periods (B) ÷ 24

Amount per pay period (A/B)

QUALIFYING MEDICAL CARE EXPENSES

Under the plan, you will be reimbursed only for those types of medical expenses normally deductible on your federal

imcome tax return (without regard to the 7.5% adjusted gross income limitation.)

Qualified expenses include, but are not necessarily limited to expenses you may have incurred for:

• Medicine, drugs, vaccines,and vitamins prescribed by your doctor.

• Medical doctors, dentist, eye doctors, chiropractors, osteopaths, podiatrists, psychiatrists, psychologists and

psychoanalysts (medical care only)

• Medical examinations, X-ray and laboratory service, insulin treatment and whirlpool baths the doctor

prescribed

• Medical aids such as hearing aids and batteries, false teeth, eyeglasses, contact lenses, braces, orthopedic

shoes, crutches, wheelchairs, guide dogs and the cost of maintaining them

• Ambulance service and other travel costs to get to medical care. If you use your own car, you can claim what

you spent for gas and to go to and from the place you received the care (mileage rate is determined by the IRS

annually for flexible spending accounts). Parking fees and tolls can also be claimed

• If you pay someone for both nursing and household help, you may be reimbursed only for the cost of nursing

• Hospital care, clinic costs and lab fees

• Medical treatment at a center for drug and alcohol addition

Guide to Your Benefits | May 1, 2022 – April 30, 2023