Page 5 - Fort Health Care 2022 Benefit Guide

P. 5

5 | P a g e

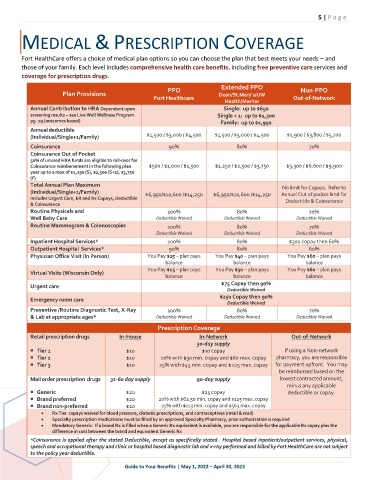

MEDICAL & PRESCRIPTION COVERAGE

Fort HealthCare offers a choice of medical plan options so you can choose the plan that best meets your needs – and

those of your family. Each level includes comprehensive health care benefits, including free preventive care services and

coverage for prescription drugs.

Extended PPO

PPO Non-PPO

Plan Provisions Dean/St.Mary’s/UW

Fort Healthcare Out-of-Network

Health/Meriter

Annual Contribution to HRA Dependent upon Single: up to $650

screening results – see Live Well Wellness Program Single + 1: up to $1,300

pg. 19 (outcomes based) Family: up to $1,950

Annual deductible

$1,500 / $3,000 / $4,500 $1,500 / $3,000 / $4,500 $1,900 / $3,800 / $5,700

(Individual/Single+1/Family)

Coinsurance 90% 80% 70%

Coinsurance Out of Pocket

50% of unused HRA funds are eligible to roll-over for

Coinsurance reimbursement in the following plan $500 / $1,000 / $1,500 $1,250 / $2,500 / $3,750 $3,300 / $6,600 / $9,900

year up to a max of $1,250 (S), $2,500 (S+1), $3,750

(F)

Total Annual Plan Maximum

No limit for Copays. Refer to

(Individual/Single+1/Family) $6,950/$10,600 /$14,250 $6,950/$10,600 /$14,250 Annual Out of pocket limit for

Includes Urgent Care, ER and Rx Copays, Deductible Deductible & Coinsurance

& Coinsurance

Routine Physicals and 100% 80% 70%

Well Baby Care Deductible Waived Deductible Waived Deductible Waived

Routine Mammogram & Colonoscopies 100% 80% 70%

Deductible Waived Deductible Waived Deductible Waived

Inpatient Hospital Services* 100% 80% $300 copay then 60%

Outpatient Hospital Services* 90% 80% 60%

Physician Office Visit (In Person) You Pay $25 – plan pays You Pay $40 – plan pays You Pay $60 – plan pays

balance balance balance

You Pay $15 – plan pays You Pay $30 – plan pays You Pay $60 – plan pays

Virtual Visits (Wisconsin Only)

balance balance balance

$75 Copay then 90%

Urgent care

Deductible Waived

$250 Copay then 90%

Emergency room care

Deductible Waived

Preventive /Routine Diagnostic Test, X-Ray 100% 80% 70%

& Lab at appropriate ages* Deductible Waived Deductible Waived Deductible Waived

Prescription Coverage

Retail prescription drugs In-House In-Network Out-of-Network

30-day supply

Tier 1 $10 $10 copay If using a Non-network

Tier 2 $10 20% with $30 min. copay and $60 max. copay pharmacy, you are responsible

Tier 3 $10 25% with $45 min. copay and $225 max. copay for payment upfront. You may

be reimbursed based on the

Mail order prescription drugs 31-60 day supply 90-day supply lowest contracted amount,

minus any applicable

Generic $20 $25 copay deductible or copay.

Brand preferred $20 20% with $62.50 min. copay and $125 max. copay

Brand non-preferred $20 25% with $113 min. copay and $563 max. copay

• Rx Tier copays waived for blood pressure, diabetic prescriptions, and contraceptives (retail & mail)

• Specialty prescription medications must be filled by an approved Specialty Pharmacy, prior authorization is required

• Mandatory Generic: If a brand Rx is filled when a Generic Rx equivalent is available, you are responsible for the applicable Rx copay plus the

difference in cost between the brand and equivalent Generic Rx

*Coinsurance is applied after the stated Deductible, except as specifically stated. Hospital based inpatient/outpatient services, physical,

speech and occupational therapy and clinic or hospital based diagnostic lab and x-ray performed and billed by Fort HealthCare are not subject

to the policy year deductible.

Guide to Your Benefits | May 1, 2022 – April 30, 2023