Page 9 - HR_10930_2022_Benefits_Book_v6_pages - With Links for Flipbook

P. 9

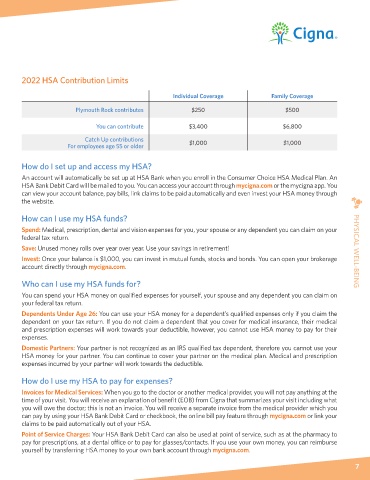

2022 HSA Contribution Limits

Individual Coverage Family Coverage

Plymouth Rock contributes $250 $500

You can contribute $3,400 $6,800

Catch Up contributions $1,000 $1,000

For employees age 55 or older

How do I set up and access my HSA?

An account will automatically be set up at HSA Bank when you enroll in the Consumer Choice HSA Medical Plan. An

HSA Bank Debit Card will be mailed to you. You can access your account through mycigna.com or the mycigna app. You

can view your account balance, pay bills, link claims to be paid automatically and even invest your HSA money through

the website.

How can I use my HSA funds?

Spend: Medical, prescription, dental and vision expenses for you, your spouse or any dependent you can claim on your

federal tax return.

Save: Unused money rolls over year over year. Use your savings in retirement! PHYSICAL WELL-BEING

Invest: Once your balance is $1,000, you can invest in mutual funds, stocks and bonds. You can open your brokerage

account directly through mycigna.com.

Who can I use my HSA funds for?

You can spend your HSA money on qualified expenses for yourself, your spouse and any dependent you can claim on

your federal tax return.

Dependents Under Age 26: You can use your HSA money for a dependent’s qualified expenses only if you claim the

dependent on your tax return. If you do not claim a dependent that you cover for medical insurance, their medical

and prescription expenses will work towards your deductible, however, you cannot use HSA money to pay for their

expenses.

Domestic Partners: Your partner is not recognized as an IRS qualified tax dependent, therefore you cannot use your

HSA money for your partner. You can continue to cover your partner on the medical plan. Medical and prescription

expenses incurred by your partner will work towards the deductible.

How do I use my HSA to pay for expenses?

Invoices for Medical Services: When you go to the doctor or another medical provider, you will not pay anything at the

time of your visit. You will receive an explanation of benefit (EOB) from Cigna that summarizes your visit including what

you will owe the doctor; this is not an invoice. You will receive a separate invoice from the medical provider which you

can pay by using your HSA Bank Debit Card or checkbook, the online bill pay feature through mycigna.com or link your

claims to be paid automatically out of your HSA.

Point of Service Charges: Your HSA Bank Debit Card can also be used at point of service, such as at the pharmacy to

pay for prescriptions, at a dental office or to pay for glasses/contacts. If you use your own money, you can reimburse

yourself by transferring HSA money to your own bank account through mycigna.com.

6 7