Page 19 - 2021 Dreyer's New Hire Guide

P. 19

DEPENDENT CARE FLEXIBLE SPENDING ACCOUNT

The Dependent Care FSA lets you set aside pretax dollars to help pay for daycare services for your eligible

dependents. The maximum amount you can contribute is $5,000 per year combined per joint filing, or

$2,500 if married and filing separate tax returns.

It’s important to estimate your expenses conservatively – the law requires that you use your expenses during

the plan year (the “use it or lose it” rule). See other Important Features below, for significant additional

clarification on the “use it or lose it” rule.

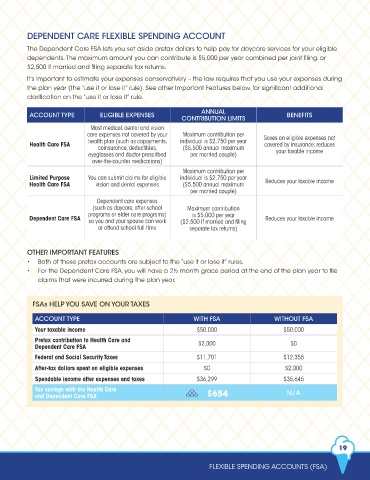

ANNUAL

ACCOUNT TYPE ELIGIBLE EXPENSES BENEFITS

CONTRIBUTION LIMITS

Most medical, dental and vision

care expenses not covered by your Maximum contribution per

health plan (such as copayments, individual is $2,750 per year Saves on eligible expenses not

Health Care FSA covered by insurance; reduces

coinsurance, deductibles, ($5,500 annual maximum

eyeglasses and doctor-prescribed per married couple) your taxable income

over-the-counter medications)

Maximum contribution per

Limited Purpose You can submit claims for eligible individual is $2,750 per year Reduces your taxable income

Health Care FSA vision and dental expenses ($5,500 annual maximum

per married couple)

Dependent care expenses

(such as daycare, after-school Maximum contribution

programs or elder care programs) is $5,000 per year

Dependent Care FSA so you and your spouse can work ($2,500 if married and filing Reduces your taxable income

or attend school full-time separate tax returns)

OTHER IMPORTANT FEATURES

• Both of these pretax accounts are subject to the “use it or lose it” rules.

• For the Dependent Care FSA, you will have a 2½ month grace period at the end of the plan year to file

claims that were incurred during the plan year.

FSAs HELP YOU SAVE ON YOUR TAXES

ACCOUNT TYPE WITH FSA WITHOUT FSA

Your taxable income $50,000 $50,000

Pretax contribution to Health Care and $2,000 $0

Dependent Care FSA

Federal and Social Security Taxes $11,701 $12,355

After-tax dollars spent on eligible expenses $0 $2,000

Spendable income after expenses and taxes $36,299 $35,645

Tax savings with the Health Care

and Dependent Care FSA $654 N/A

19

FLEXIBLE SPENDING ACCOUNTS (FSA)