Page 7 - Siemens Gamesa 2022 PY Benefits Guide

P. 7

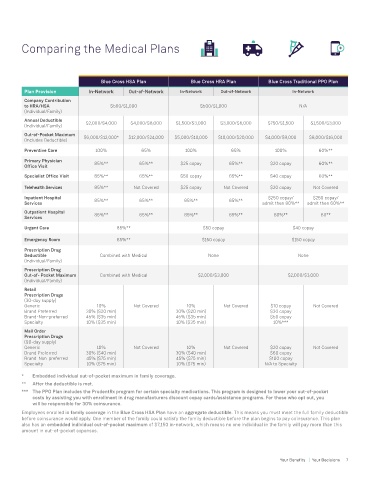

Comparing the Medical Plans

Blue Cross HSA Plan Blue Cross HRA Plan Blue Cross Traditional PPO Plan

Plan Provision In-Network Out-of-Network In-Network Out-of-Network In-Network

Company Contribution

to HRA/HSA $500/$1,000 $500/$1,000 N/A

(Individual/Family)

Annual Deductible $2,000/$4,000 $4,000/$8,000 $1,500/$3,000 $3,000/$6,000 $750/$1,500 $1,500/$3,000

(Individual/Family)

Out-of-Pocket Maximum $6,000/$12,000* $12,000/$24,000 $5,000/$10,000 $10,000/$20,000 $4,000/$8,000 $8,000/$16,000

(Includes Deductible)

Preventive Care 100% 65% 100% 65% 100% 60%**

Primary Physician 85%** 65%** $25 copay 65%** $20 copay 60%**

Office Visit

Specialist Office Visit 85%** 65%** $50 copay 65%** $40 copay 60%**

Telehealth Services 85%** Not Covered $25 copay Not Covered $20 copay Not Covered

Inpatient Hospital 85%** 65%** 85%** 65%** $250 copay/ $250 copay/

Services admit then 80%** admit then 60%**

Outpatient Hospital

Services 85%** 65%** 85%** 65%** 80%** 60**

Urgent Care 85%** $50 copay $40 copay

Emergency Room 85%** $150 copay $150 copay

Prescription Drug

Deductible Combined with Medical None None

(Individual/Family)

Prescription Drug

Out-of- Pocket Maximum Combined with Medical $2,000/$3,000 $2,000/$3,000

(Individual/Family)

Retail

Prescription Drugs

(30-day supply)

Generic 10% Not Covered 10% Not Covered $10 copay Not Covered

Brand Preferred 30% ($20 min) 30% ($20 min) $30 copay

Brand-Non-preferred 45% ($35 min) 45% ($35 min) $50 copay

Specialty 10% ($35 min) 10% ($35 min) 10%***

Mail Order

Prescription Drugs

(90-day supply)

Generic 10% Not Covered 10% Not Covered $20 copay Not Covered

Brand Preferred 30% ($40 min) 30% ($40 min) $60 copay

Brand-Non-preferred 45% ($75 min) 45% ($75 min) $100 copay

Specialty 10% ($75 min) 10% ($75 min) N/A to Specialty

* Embedded individual out-of-pocket maximum in family coverage.

** After the deductible is met.

*** The PPO Plan includes the PrudentRx program for certain specialty medications. This program is designed to lower your out-of-pocket

costs by assisting you with enrollment in drug manufacturers discount copay cards/assistance programs. For those who opt out, you

will be responsible for 30% coinsurance.

Employees enrolled in family coverage in the Blue Cross HSA Plan have an aggregate deductible. This means you must meet the full family deductible

before coinsurance would apply. One member of the family could satisfy the family deductible before the plan begins to pay coinsurance. This plan

also has an embedded individual out-of-pocket maximum of $7,150 in-network, which means no one individual in the family will pay more than this

amount in out-of-pocket expenses.

6 Your Benefits | Your Decisions Your Benefits | Your Decisions 7