Page 14 - 2022 Arabella Advisors Benefit Guide

P. 14

Health Savings Account

Arabella Advisors’ Health Savings Account (HSA) will pay for a portion of eligible health care expenses for you

and your family. Types of expenses include the medical deductible, prescription drug, dental and vision

expenses. If you have HSA dollars left at the end of the year, they roll over to help pay for eligible expenses in

the future. To have the Arabella HSA, you must enroll in the HSA medical plan.

Arabella will contribute funds toward this account. Keep in mind that if you enroll in the HAS, you cannot

enroll into the HRA or Health Care FSA.

HSA Highlights

When you enroll in the HSA-eligible medical plan, you need to actively open your HSA to save your own money

and to receive dollars from Arabella. You will also receive a debit card in the mail. When you receive it, please

remember to activate and sign your card.

You can save your own money tax free, up to IRS limits. You can also invest your HSA funds tax free. You can

use your HSA funds for eligible medical expenses at any time tax free, as well.

You keep your HSA balance, even if you leave Arabella or choose to waive medical coverage in the future. If

you choose to waive medical coverage, you can no longer contribute to your HSA, but the balance is always

yours. You can also assign beneficiaries for the HSA.

How To Use Your HSA:

You may want to wait to pay a bill in full until you receive a final bill in the mail. This will ensure any discounts

are applied first. Or, if you choose the debit card option, just swipe your card to pay for your eligible expenses

at the time of service.

For example, if you are going to a physical therapist to help recover from an injury, you are likely to pay the

deductible. Your HSA funds will be there to help you pay for this service.

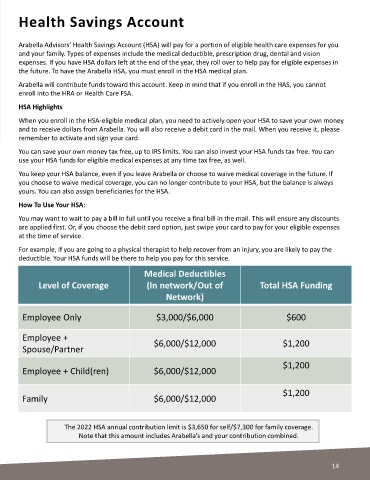

Medical Deductibles

Level of Coverage (In network/Out of Total HSA Funding

Network)

Employee Only $3,000/$6,000 $600

Employee +

Spouse/Partner $6,000/$12,000 $1,200

$1,200

Employee + Child(ren) $6,000/$12,000

$1,200

Family $6,000/$12,000

The 2022 HSA annual contribution limit is $3,650 for self/$7,300 for family coverage.

Note that this amount includes Arabella’s and your contribution combined.

13

14