Page 3 - 2022 Arabella Advisors Benefit Guide

P. 3

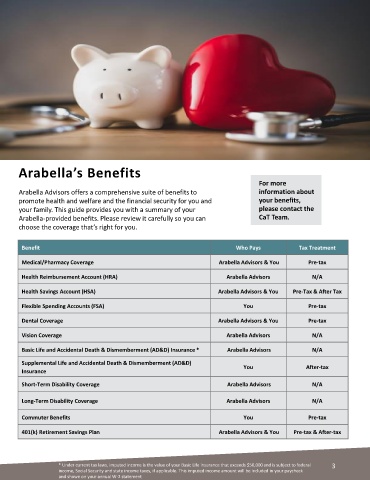

Arabella’s Benefits

For more

Arabella Advisors offers a comprehensive suite of benefits to information about

promote health and welfare and the financial security for you and your benefits,

your family. This guide provides you with a summary of your please contact the

Arabella-provided benefits. Please review it carefully so you can CaT Team.

choose the coverage that’s right for you.

Benefit Who Pays Tax Treatment

Medical/Pharmacy Coverage Arabella Advisors & You Pre-tax

Health Reimbursement Account (HRA) Arabella Advisors N/A

Health Savings Account (HSA) Arabella Advisors & You Pre-Tax & After Tax

Flexible Spending Accounts (FSA) You Pre-tax

Dental Coverage Arabella Advisors & You Pre-tax

Vision Coverage Arabella Advisors N/A

Basic Life and Accidental Death & Dismemberment (AD&D) Insurance * Arabella Advisors N/A

Supplemental Life and Accidental Death & Dismemberment (AD&D)

You After-tax

Insurance

Short-Term Disability Coverage Arabella Advisors N/A

Long-Term Disability Coverage Arabella Advisors N/A

Commuter Benefits You Pre-tax

401(k) Retirement Savings Plan Arabella Advisors & You Pre-tax & After-tax

* Under current tax laws, imputed income is the value of your Basic Life insurance that exceeds $50,000 and is subject to federal 3

income, Social Security and state income taxes, if applicable. This imputed income amount will be included in your paycheck

and shown on your annual W-2 statement