Page 12 - 2021 Marcolin Benefit Guide

P. 12

Flexible Spending Account (FSA)

How the Account Works

Each pay period you contribute to your FSA, just like you would a savings account. Then, like a savings account, when you

need money, you take it out. You may use your FSA debit card to pay for qualified expenses at the point of service.

Another option is to fill out a claim form and attach your medical/dependent care receipts. The Plan Administrator will mail

a check for the expense. It’s that simple.

Please note: for your medical expense FSA, the full annual amount you elected is available to you right away; for your

dependent care expense FSA, only the amount you’ve contributed so far is available for reimbursement.

How Much Should You Contribute?

The key to effectively using FSAs is figuring out how much to contribute each pay period. If you contribute less than the

amount of your actual eligible expenses, you miss out on some tax savings. If you contribute more than the amount of your

actual eligible expenses, you give up the extra money. IRS rules state that unlike a savings account, if you don’t use the

money in your account each year, you lose the leftover amount. Therefore, be conservative in your estimates.

How Much Can You Contribute?

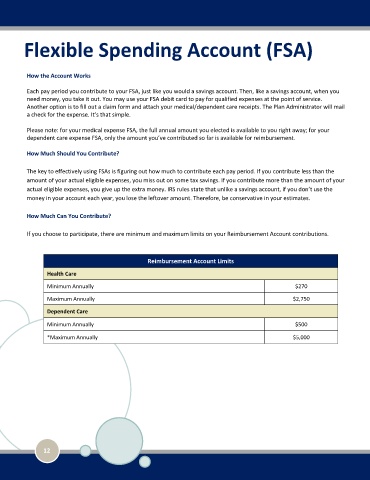

If you choose to participate, there are minimum and maximum limits on your Reimbursement Account contributions.

Reimbursement Account Limits

Health Care

Minimum Annually $270

Maximum Annually $2,750

Dependent Care

Minimum Annually $500

*Maximum Annually $5,000

12