Page 7 - 2021 Marcolin Benefit Guide

P. 7

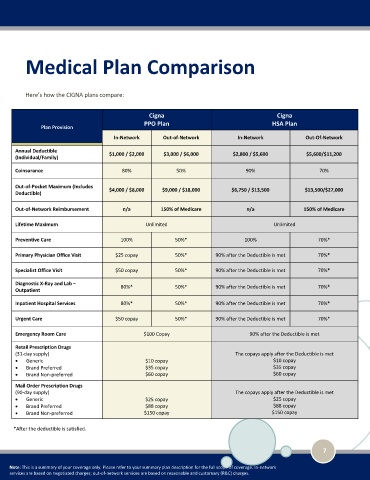

Medical Plan Comparison

Here’s how the CIGNA plans compare:

Cigna Cigna

PPO Plan HSA Plan

Plan Provision

In-Network Out-of-Network In-Network Out-Of-Network

Annual Deductible $1,000 / $2,000 $3,000 / $6,000 $2,800 / $5,600 $5,600/$11,200

(Individual/Family)

Coinsurance 80% 50% 90% 70%

Out-of-Pocket Maximum (Includes $4,000 / $8,000 $9,000 / $18,000 $6,750 / $13,500 $13,500/$27,000

Deductible)

Out-of-Network Reimbursement n/a 150% of Medicare n/a 150% of Medicare

Lifetime Maximum Unlimited Unlimited

Preventive Care 100% 50%* 100% 70%*

Primary Physician Office Visit $25 copay 50%* 90% after the Deductible is met 70%*

Specialist Office Visit $50 copay 50%* 90% after the Deductible is met 70%*

Diagnostic X-Ray and Lab – 80%* 50%* 90% after the Deductible is met 70%*

Outpatient

Inpatient Hospital Services 80%* 50%* 90% after the Deductible is met 70%*

Urgent Care $50 copay 50%* 90% after the Deductible is met 70%*

Emergency Room Care $100 Copay 90% after the Deductible is met

Retail Prescription Drugs

(31-day supply) The copays apply after the Deductible is met

• Generic $10 copay $10 copay

• Brand Preferred $35 copay $35 copay

• Brand Non-preferred $60 copay $60 copay

Mail Order Prescription Drugs

(90-day supply) The copays apply after the Deductible is met

• Generic $25 copay $25 copay

• Brand Preferred $88 copay $88 copay

• Brand Non-preferred $150 copay $150 copay

*After the deductible is satisfied.

7

Note: This is a summary of your coverage only. Please refer to your summary plan description for the full scope of coverage. In-network

services are based on negotiated charges; out-of-network services are based on reasonable and customary (R&C) charges.