Page 6 - ABC Company 2018 Open Enrollment Guide

P. 6

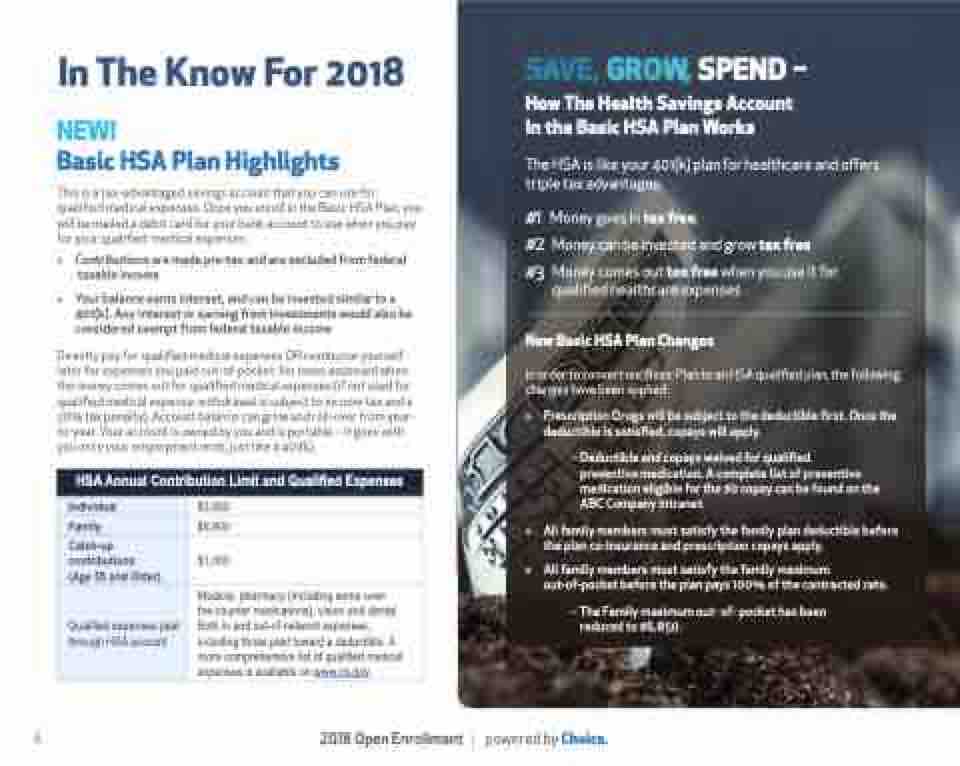

In The Know For 2018

NEW!

Basic HSA Plan Highlights

This is a tax-advantaged savings account that you can use for qualified medical expenses. Once you enroll in the Basic HSA Plan, you will be mailed a debit card for your bank account to use when you pay for your qualified medical expenses.

» Contributions are made pre-tax and are excluded from federal taxable income

» Your balance earns interest, and can be invested similar to a 401(k). Any interest or earning from investments would also be considered exempt from federal taxable income

Directly pay for qualified medical expenses OR reimburse yourself later for expenses you paid out-of-pocket. No taxes assessed when the money comes out for qualified medical expenses (if not used for qualified medical expense, withdrawal is subject to income tax and a 20% tax penalty). Account balance can grow and roll-over from year- to-year. Your account is owned by you and is portable – it goes with you once your employment ends, just like a 401(k).

HSA Annual Contribution Limit and Qualified Expenses

Individual

$3,450

Family

$6,900

Catch-up contributions

(Age 55 and Older)

$1,000

Qualified expenses paid through HSA account

Medical, pharmacy (including some over- the-counter medications), vision and dental. Both in and out-of-network expenses, including those paid toward a deductible. A more comprehensive list of qualified medical expenses is available on www.irs.gov.

6

2018 Open Enrollment | powered by Choice.

SAVE, GROW, SPEND – How The Health Savings Account

In the Basic HSA Plan Works

The HSA is like your 401(k) plan for healthcare and offers triple tax advantages:

#1 Money goes in tax free;

#2 Money can be invested and grow tax free

#3 Money comes out tax free when you use it for qualified healthcare expenses

New Basic HSA Plan Changes

In order to convert our Basic Plan to an HSA qualified plan, the following changes have been applied:

» Prescription Drugs will be subject to the deductible first. Once the deductible is satisfied, copays will apply.

– Deductible and copays waived for qualified

preventive medication. A complete list of preventive medication eligible for the $0 copay can be found on the ABC Company intranet.

» All family members must satisfy the family plan deductible before the plan co-insurance and prescription copays apply.

» All family members must satisfy the family maximum out-of-pocket before the plan pays 100% of the contracted rate.

– The Family maximum out- of- pocket has been reduced to $6,850.