Page 63 - Beeks Financial Cloud Group Annual Report 2021

P. 63

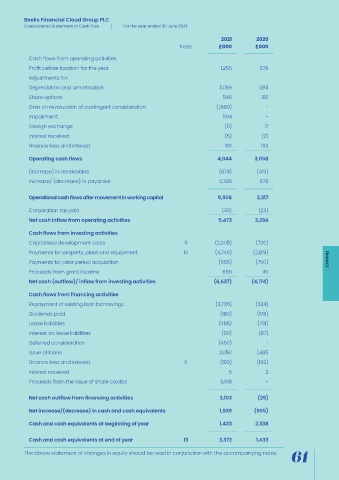

Beeks Financial Cloud Group PLC

Consolidated Statement of Cash Flow For the year ended 30 June 2021

2021 2020

Note £000 £000

Cash flows from operating activities

Profit before taxation for the year 1,255 678

Adjustments for:

Depreciation and amortisation 3,059 1,861

Share options 546 312

Gain on revaluation of contingent consideration (1,989) -

Impairment 994 -

Foreign exchange (6) 17

Interest received (5) (2)

Finance fees and interest 190 192

Operating cash flows 4,044 3,058

(Increase) in receivables (874) (419)

Increase/ (decrease) in payables 2,336 678

Operational cash flows after movement in working capital 5,506 3,317

Corporation tax paid (33) (23)

Net cash inflow from operating activities 5,473 3,294

Cash flows from investing activities

Capitalised development costs 9 (2,005) (720)

Payments for property, plant and equipment 10 (4,746) (2,819)

Payments for prior period acquisition (555) (750) FINANCE

Proceeds from grant income 669 115

Net cash (outflow)/ inflow from investing activities (6,637) (4,174)

Cash flows from financing activities

Repayment of existing loan borrowings (3,736) (324)

Dividends paid (180) (178)

Lease liabilities (485) (731)

Interest on lease liabilities (99) (87)

Deferred consideration (460) -

Issue of loans 3,050 1,485

Finance fees and interest 5 (190) (192)

Interest received 5 2

Proceeds from the issue of share capital 5,198 -

Net cash outflow from financing activities 3,103 (25)

Net increase/(decrease) in cash and cash equivalents 1,939 (905)

Cash and cash equivalents at beginning of year 1,433 2,338

Cash and cash equivalents at end of year 13 3,372 1,433

61

The above statement of changes in equity should be read in conjunction with the accompanying notes.