Page 255 - bune practici proiect Erasmus

P. 255

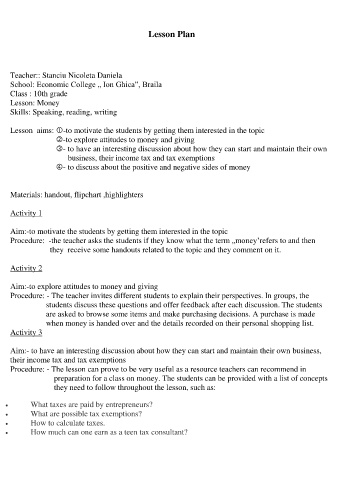

Lesson Plan

Teacher:: Stanciu Nicoleta Daniela

School: Economic College „ Ion Ghica”, Braila

Class : 10th grade

Lesson: Money

Skills: Speaking, reading, writing

Lesson aims: -to motivate the students by getting them interested in the topic

-to explore attitudes to money and giving

- to have an interesting discussion about how they can start and maintain their own

business, their income tax and tax exemptions

- to discuss about the positive and negative sides of money

Materials: handout, flipchart ,highlighters

Activity 1

Aim:-to motivate the students by getting them interested in the topic

Procedure: -the teacher asks the students if they know what the term „money’refers to and then

they receive some handouts related to the topic and they comment on it.

Activity 2

Aim:-to explore attitudes to money and giving

Procedure: - The teacher invites different students to explain their perspectives. In groups, the

students discuss these questions and offer feedback after each discussion. The students

are asked to browse some items and make purchasing decisions. A purchase is made

when money is handed over and the details recorded on their personal shopping list.

Activity 3

Aim:- to have an interesting discussion about how they can start and maintain their own business,

their income tax and tax exemptions

Procedure: - The lesson can prove to be very useful as a resource teachers can recommend in

preparation for a class on money. The students can be provided with a list of concepts

they need to follow throughout the lesson, such as:

What taxes are paid by entrepreneurs?

What are possible tax exemptions?

How to calculate taxes.

How much can one earn as a teen tax consultant?