Page 109 - FBL AR 2019-20

P. 109

CORPORATE STATUTORY FINANCIAL

OVERVIEW STATEMENTS STATEMENTS

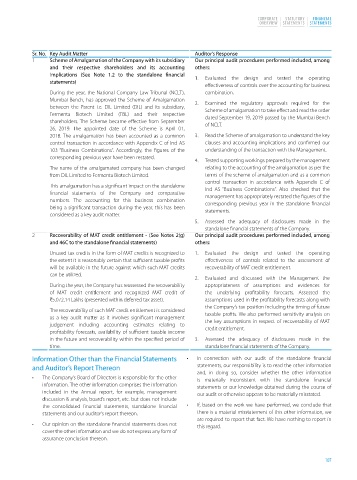

Sr. No. Key Audit Matter Auditor’s Response

1 Scheme of Amalgamation of the Company with its subsidiary Our principal audit procedures performed included, among

and their respective shareholders and its accounting others:

implications (See Note 1.2 to the standalone financial 1. Evaluated the design and tested the operating

statements)

effectiveness of controls over the accounting for business

During the year, the National Company Law Tribunal (NCLT), combination.

Mumbai Bench, has approved the Scheme of Amalgamation 2. Examined the regulatory approvals required for the

between the Parent i.e. DIL Limited (DIL) and its subsidiary, Scheme of amalgamation to take effect and read the order

Fermenta Biotech Limited (FBL) and their respective dated September 19, 2019 passed by the Mumbai Bench

shareholders. The Scheme became effective from September of NCLT.

26, 2019. The appointed date of the Scheme is April 01,

2018. The amalgamation has been accounted as a common 3. Read the Scheme of amalgamation to understand the key

control transaction in accordance with Appendix C of Ind AS clauses and accounting implications and confirmed our

103 “Business Combinations”. Accordingly, the figures of the understanding of the transaction with the Management.

corresponding previous year have been restated.

4. Tested supporting workings prepared by the management

The name of the amalgamated company has been changed relating to the accounting of the amalgamation as per the

from DIL Limited to Fermenta Biotech Limited. terms of the scheme of amalgamation and as a common

control transaction in accordance with Appendix C of

This amalgamation has a significant impact on the standalone Ind AS “Business Combinations”. Also checked that the

financial statements of the Company and comparative management has appropriately restated the figures of the

numbers. The accounting for this business combination corresponding previous year in the standalone financial

being a significant transaction during the year, this has been statements.

considered as a key audit matter.

5. Assessed the adequacy of disclosures made in the

standalone financial statements of the Company.

2 Recoverability of MAT credit entitlement - (See Notes 2(g) Our principal audit procedures performed included, among

and 46C to the standalone financial statements) others:

Unused tax credits in the form of MAT credits is recognized to 1. Evaluated the design and tested the operating

the extent it is reasonably certain that sufficient taxable profits effectiveness of controls related to the assessment of

will be available in the future against which such MAT credits recoverability of MAT credit entitlement.

can be utilized.

2. Evaluated and discussed with the Management the

During the year, the Company has reassessed the recoverability appropriateness of assumptions and evidences for

of MAT credit entitlement and recognized MAT credit of the underlying profitability forecasts. Assessed the

H5,072.14 Lakhs (presented within deferred tax asset). assumptions used in the profitability forecasts along with

the Company’s tax position including the timing of future

The recoverability of such MAT credit entitlement is considered taxable profits. We also performed sensitivity analysis on

as a key audit matter as it involves significant management the key assumptions in respect of recoverability of MAT

judgement including accounting estimates relating to credit entitlement.

profitability forecasts, availability of sufficient taxable income

in the future and recoverability within the specified period of 3. Assessed the adequacy of disclosures made in the

time. standalone financial statements of the Company.

Information Other than the Financial Statements • In connection with our audit of the standalone financial

and Auditor’s Report Thereon statements, our responsibility is to read the other information

and, in doing so, consider whether the other information

• The Company’s Board of Directors is responsible for the other is materially inconsistent with the standalone financial

information. The other information comprises the information statements or our knowledge obtained during the course of

included in the Annual report, for example, management our audit or otherwise appears to be materially misstated.

discussion & analysis, board’s report, etc. but does not include

the consolidated financial statements, standalone financial • If, based on the work we have performed, we conclude that

statements and our auditor’s report thereon. there is a material misstatement of this other information, we

are required to report that fact. We have nothing to report in

• Our opinion on the standalone financial statements does not this regard.

cover the other information and we do not express any form of

assurance conclusion thereon.

107