Page 24 - 83628_NSAA_SummerVol26

P. 24

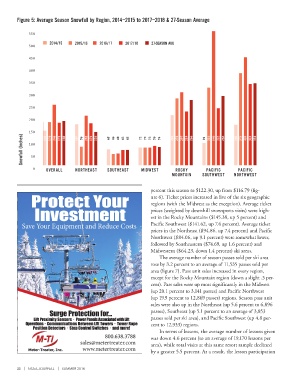

Figure 5: Average Season Snowfall by Region, 2014–2015 to 2017–2018 & 27-Season Average

550

2014/15 2015/16 2016/17 2017/18 27-SEASON AVG

500

450

400

350

300

250

200

150 141 176 246 173 180 167 76 202 171 136 65 46 48 62 63 72 72 72 79 74 204 272 297 219 266 91 316 546 232 282 165 375 439 331 334

Snowfall (Inches) 100

50

0 OVERALL NORTHEAST SOUTHEAST MIDWEST ROCKY PACIFIC PACIFIC

MOUNTAIN SOUTHWEST NORTHWEST

percent this season to $122.30, up from $116.79 (fig-

ure 6). Ticket prices increased in five of the six geographic

regions (with the Midwest as the exception). Average ticket

prices (weighted by downhill snowsports visits) were high-

est in the Rocky Mountains ($145.38, up 5 percent) and

Pacific Southwest ($141.62, up 7.6 percent). Average ticket

prices in the Northeast ($94.86, up 7.4 percent) and Pacific

Northwest ($84.06, up 9.1 percent) were somewhat lower,

followed by Southeastern ($74.69, up 1.6 percent) and

Midwestern ($64.23, down 1.4 percent) ski areas.

The average number of season passes sold per ski area

rose by 3.2 percent to an average of 11,535 passes sold per

area (figure 7). Pass unit sales increased in every region,

except for the Rocky Mountain region (down a slight .3 per-

cent). Pass sales were up most significantly in the Midwest

(up 20.1 percent to 3,141 passes) and Pacific Northwest

(up 19.9 percent to 12,869 passes) regions. Season pass unit

sales were also up in the Northeast (up 5.6 percent to 6,896

passes), Southeast (up 5.1 percent to an average of 3,853

passes sold per ski area), and Pacific Southwest (up 4.8 per-

cent to 12,933) regions.

In terms of lessons, the average number of lessons given

was down 4.6 percent (to an average of 19,170 lessons per

area), while total visits at this same resort sample declined

by a greater 5.5 percent. As a result, the lesson participation

22 | NSAA JOURNAL | SUMMER 2018