Page 26 - 83628_NSAA_SummerVol26

P. 26

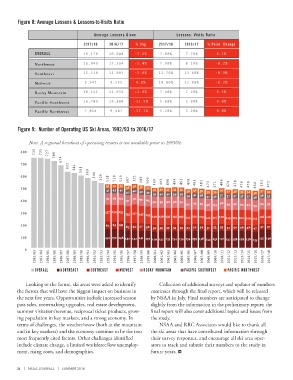

Figure 8: Average Lessons & Lessons-to-Visits Ratio

Average Lessons Given Lessons: Visits Ratio

BISON X

2017/18 2016/17 % Chg 2017/18 2016/17 % Point Change

OVERALL 19,170 20,088 -4.6% 7.80% 7.70% 0.1% THE ULTIMATE

Northwest 16,949 17,364 -2.4% 7.90% 8.10% -0.2%

Southeast 15,110 15,901 -5.0% 12.70% 13.60% -0.9% XPERIENCE

Midwest 9,941 9,555 4.0% 10.80% 12.00% -1.2%

Rocky Mountain 30,141 31,056 -2.9% 7.40% 7.20% 0.3%

Pacific Southwest 16,789 19,880 -15.5% 5.80% 5.80% 0.0%

Pacific Northwest 7,864 9,487 -17.1% 5.20% 5.20% 0.0%

Figure 9: Number of Operating US Ski Areas, 1992/93 to 2016/17

Note: A regional breakout of operating resorts is not available prior to 1993/94.

800 735 735 727 709

700 674

622 611 591

600 569 546 529 518 520 519 507 521 509 503

35 35 35 38 36 34 489 493 490 494 492 478 485 481 473 471 486 474 478 470 470 464 481 472

500 41 43 41 38 35 36 35 35 35 38 39 39

40 40 40 39 38 39 39 37 38 33 34 38 37 35

39 40 40 39 39 39 41 38 37 37 37 35 37 38 35

91 93 94 90 90 94 37 36 38

400 91 90 93 92 96 94

92 93 93 96 93 96 93 96 94 94 93 94 93

300 137 134 135 135 151 145 143

140 136 135 135 135 122 120 119 116 115 120 119 119 120 119 113 118 116

200 64 65 68 63 60 57 56 56 56 55 55 55 53 54 54 51 53 53 51 50 49 48 47 47 47

100 150 150 146 140 142 141 137 129 132 133 134 134 134 139 138 134 135 141 137 138 139 138 135 147 146

0

1982/83 1983/84 1984/85 1985/86 1986/87 1987/88 1988/89 1989/90 1990/91 1991/92 1992/93 1993/94 1994/95 1995/96 1996/97 1997/98 1998/99 1999/00 2000/01 2001/02 2002/03 2003/04 2004/05 2005/06 2006/07 2007/08 2008/09 2009/10 2010/11 2011/12 2012/13 2013/14 2014/15 2015/16 2016/17 2017/18

OVERALL NORTHEAST SOUTHEAST MIDWEST ROCKY MOUNTAIN PACIFIC SOUTHWEST PACIFIC NORTHWEST

Looking to the future, ski areas were asked to identify Collection of additional surveys and updates of numbers

the factors that will have the biggest impact on business in continues through the final report, which will be released

the next five years. Opportunities include increased season by NSAA in July. Final numbers are anticipated to change

pass sales, snowmaking upgrades, real estate development, slightly from the information in the preliminary report; the

summer visitation/revenue, reciprocal ticket products, grow- final report will also cover additional topics and issues from

ing population in key markets, and a strong economy. In the study. BISON X IS THE PERFECT FUSION

terms of challenges, the weather/snow (both at the mountain NSAA and RRC Associates would like to thank all OF PERFORMANCE AND POTENTIAL.

and in key markets) and the economy continue to be the two the ski areas that have contributed information through Driven by a relentless 400 HP (298 kW) Tier 4 final engine with exceptional

most frequently cited factors. Other challenges identified their survey responses, and encourage all ski area oper- torque, it combines thrust & manoeuvrability with cab comfort and enhanced

include climate change, a limited workforce/low unemploy- ators to track and submit their numbers to the study in blade movement. Every inch of this exceptional machine is engineered for

ment, rising costs, and demographics. future years. park-building excellence. Therefore, the best park builders in the world rely on

PRINOTH’s BISON X. The Ultimate Xperience isn’t just a slogan. It’s a promise.

prinoth.com

24 | NSAA JOURNAL | SUMMER 2018