Page 10 - 83998_NSAA_Journal_Fall2018

P. 10

Research

Lessons about the future of their business. Altogether, the survey

The issue of lesson participation, particularly at the entry respondents’ total expenditures on capital improvements

level, has been an area of focus for the industry, especially increased by 29.2 percent from 2016–17 ($274 million)

as a key element of the strategy for attracting newcomers to 2017–18 ($354.1 million). Capital expenditures are ELIMINATE THE GEAR BOX

to snowsports and converting first-timers into committed, projected to grow again to $392 million in 2018–19

long-term participants (also known as beginner conversion). (up 10.7 percent). specifically designed and supported by leitner poma,

Aggregate lessons given decreased by 1.6 percent nation- Here is some detail on the categorization of the for superior ropeway efficiency

ally this season. Absolute lesson volumes were up in the investment amounts:

Midwest, and down in all five other regions. The share of • Spending on other on-mountain facilities/support, the

visits that included a lesson (i.e., lesson participation rate) largest category of capital spending, increased from

held almost steady at 7.7 percent nationally this season, $132.7 million in 2016–17 to $206 million in 2017–18,

decreasing only marginally from 7.8 percent last season, but is expected to dip to $190.5 million in 2018–19.

while fluctuating at the regional level. Maintaining or • Spending on lifts was up from 2016–17 ($56.1 million)

increasing lesson participation rates remains important to 2017–18 ($57.8 million) and is projected to rise to

for the long-term growth of snowsports. $102 million in 2018–19.

Looking at Level 1 lessons only, the average ski area • Expenditures on real estate have been on a downward

taught 7,428 Level 1 lessons, down 2.1 percent over 2016–17. trend, declining from $74.9 million in 2016–17 to

Continued efforts with lesson programs and follow-up aimed $67.8 million in 2016–17, but is projected to rebound

at beginners are critical to the long-term health of the industry. to $86.6 million in 2018–19.

• Dollars invested on summer-/fall-specific on-mountain

Capital Improvements facilities and support was $10.3 million in 2016–17,

The amount of capital expenditures in the industry is a good jumped to $22.4 million in 2017–18, but is expected

indicator of the level of confidence among resort owners to fall to $12.9 million in 2018–19.

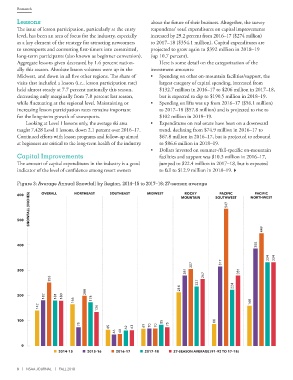

Figure 3: Average Annual Snowfall by Region, 2014–15 to 2017–18; 27-season average

PACIFIC

SNOWFALL (INCHES) 547

ROCKY

PACIFIC

600 OVERALL NORTHEAST SOUTHEAST MIDWEST MOUNTAIN SOUTHWEST NORTHWEST

500

449

400 388

334 334 VARIABLE FREquENcy DRIVE (VFD) FOR ALL INDucTION MOTORs

307 317

281 281

300

253 267

237

214 224

200

182 181 180

200

166 174 160

142 136

100 85 88

75 70 70 75

65 62 63 69

46 48

0

2014–15 2015–16 2016–17 2017–18 27-SEASON AVERAGE (91–92 TO 17–18)SEASON AVERAGE (91–92 TO 17–18)

2017–18

2014–15

27-

2015–16

2016–17

TO LEARN MORE, CALL OR VISIT:

970-257-4522 | www.leitner-poma.com/product/leitner-directdrive

8 | NSAA JOURNAL | FALL 2018