Page 16 - LILITED LIABILITY COMPANIES - INTERMEDIATE

P. 16

COMPANY ACCOUNTING SESSION 14

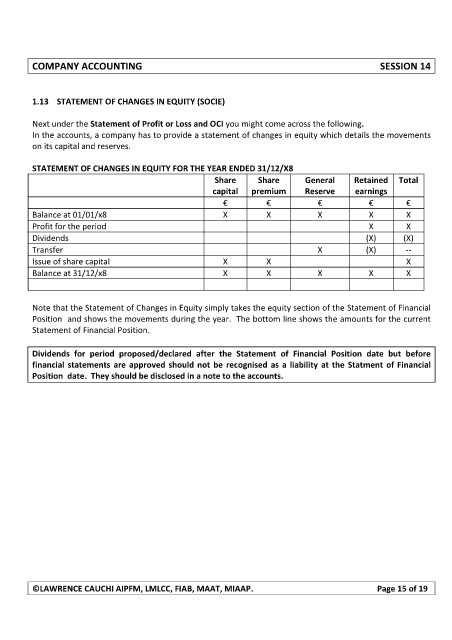

1.13 STATEMENT OF CHANGES IN EQUITY (SOCIE)

Next under the Statement of Profit or Loss and OCI you might come across the following.

In the accounts, a company has to provide a statement of changes in equity which details the movements

on its capital and reserves.

STATEMENT OF CHANGES IN EQUITY FOR THE YEAR ENDED 31/12/X8

Share Share General Retained Total

capital premium Reserve earnings

€ € € € €

Balance at 01/01/x8 X X X X X

Profit for the period X X

Dividends (X) (X)

Transfer X (X) --

Issue of share capital X X X

Balance at 31/12/x8 X X X X X

Note that the Statement of Changes in Equity simply takes the equity section of the Statement of Financial

Position and shows the movements during the year. The bottom line shows the amounts for the current

Statement of Financial Position.

Dividends for period proposed/declared after the Statement of Financial Position date but before

financial statements are approved should not be recognised as a liability at the Statment of Financial

Position date. They should be disclosed in a note to the accounts.

©LAWRENCE CAUCHI AIPFM, LMLCC, FIAB, MAAT, MIAAP. Page 15 of 19