Page 17 - LILITED LIABILITY COMPANIES - INTERMEDIATE

P. 17

COMPANY ACCOUNTING SESSION 14

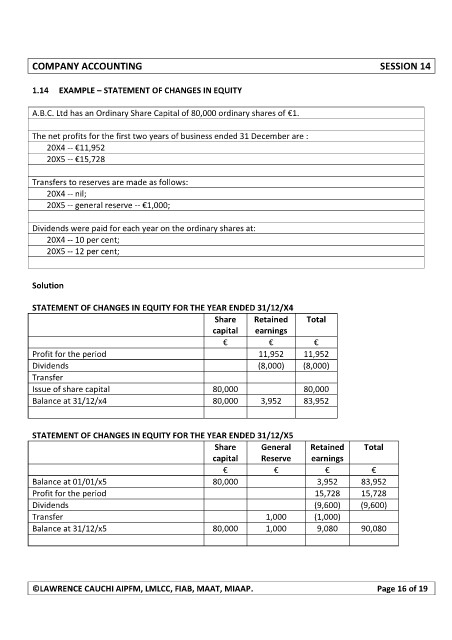

1.14 EXAMPLE – STATEMENT OF CHANGES IN EQUITY

A.B.C. Ltd has an Ordinary Share Capital of 80,000 ordinary shares of €1.

The net profits for the first two years of business ended 31 December are :

20X4 -- €11,952

20X5 -- €15,728

Transfers to reserves are made as follows:

20X4 -- nil;

20X5 -- general reserve -- €1,000;

Dividends were paid for each year on the ordinary shares at:

20X4 -- 10 per cent;

20X5 -- 12 per cent;

Solution

STATEMENT OF CHANGES IN EQUITY FOR THE YEAR ENDED 31/12/X4

Share Retained Total

capital earnings

€ € €

Profit for the period 11,952 11,952

Dividends (8,000) (8,000)

Transfer

Issue of share capital 80,000 80,000

Balance at 31/12/x4 80,000 3,952 83,952

STATEMENT OF CHANGES IN EQUITY FOR THE YEAR ENDED 31/12/X5

Share General Retained Total

capital Reserve earnings

€ € € €

Balance at 01/01/x5 80,000 3,952 83,952

Profit for the period 15,728 15,728

Dividends (9,600) (9,600)

Transfer 1,000 (1,000)

Balance at 31/12/x5 80,000 1,000 9,080 90,080

©LAWRENCE CAUCHI AIPFM, LMLCC, FIAB, MAAT, MIAAP. Page 16 of 19