Page 18 - Green Builder Nov-Dec 2021 Issue

P. 18

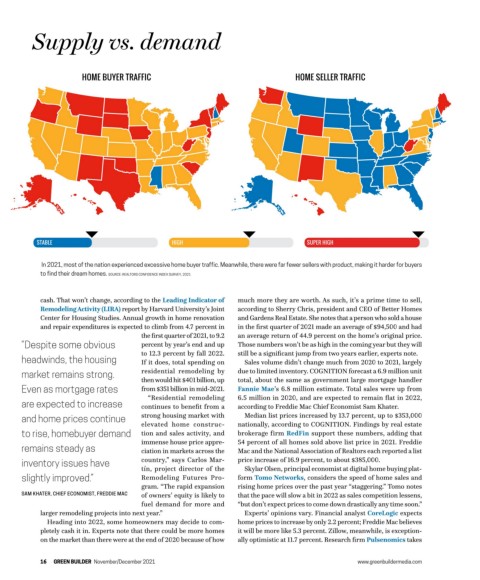

Supply vs. demand

HOME BUYER TRAFFIC HOME SELLER TRAFFIC

STABLE HIGH SUPER HIGH

In 2021, most of the nation experienced excessive home buyer traffic. Meanwhile, there were far fewer sellers with product, making it harder for buyers

to find their dream homes. SOURCE: REALTORS CONFIDENCE INDEX SURVEY, 2021

cash. That won’t change, according to the Leading Indicator of much more they are worth. As such, it’s a prime time to sell,

Remodeling Activity (LIRA) report by Harvard University’s Joint according to Sherry Chris, president and CEO of Better Homes

Center for Housing Studies. Annual growth in home renovation and Gardens Real Estate. She notes that a person who sold a house

and repair expenditures is expected to climb from 4.7 percent in in the first quarter of 2021 made an average of $94,500 and had

the first quarter of 2021, to 9.2 an average return of 44.9 percent on the home’s original price.

“Despite some obvious percent by year’s end and up Those numbers won’t be as high in the coming year but they will

to 12.3 percent by fall 2022. still be a significant jump from two years earlier, experts note.

headwinds, the housing If it does, total spending on Sales volume didn’t change much from 2020 to 2021, largely

market remains strong. residential remodeling by due to limited inventory. COGNITION forecast a 6.9 million unit

then would hit $401 billion, up total, about the same as government large mortgage handler

Even as mortgage rates from $351 billion in mid-2021. Fannie Mae’s 6.8 million estimate. Total sales were up from

“Residential remodeling 6.5 million in 2020, and are expected to remain flat in 2022,

are expected to increase continues to benefit from a according to Freddie Mac Chief Economist Sam Khater.

and home prices continue strong housing market with Median list prices increased by 13.7 percent, up to $353,000

elevated home construc- nationally, according to COGNITION. Findings by real estate

to rise, homebuyer demand tion and sales activity, and brokerage firm RedFin support these numbers, adding that

immense house price appre- 54 percent of all homes sold above list price in 2021. Freddie

remains steady as ciation in markets across the Mac and the National Association of Realtors each reported a list

inventory issues have country,” says Carlos Mar- price increase of 16.9 percent, to about $385,000.

tín, project director of the Skylar Olsen, principal economist at digital home buying plat-

slightly improved.” Remodeling Futures Pro- form Tomo Networks, considers the speed of home sales and

gram. “The rapid expansion rising home prices over the past year “staggering.” Tomo notes

SAM KHATER, CHIEF ECONOMIST, FREDDIE MAC of owners’ equity is likely to that the pace will slow a bit in 2022 as sales competition lessens,

fuel demand for more and “but don’t expect prices to come down drastically any time soon.”

larger remodeling projects into next year.” Experts’ opinions vary. Financial analyst CoreLogic expects

Heading into 2022, some homeowners may decide to com- home prices to increase by only 2.2 percent; Freddie Mac believes

pletely cash it in. Experts note that there could be more homes it will be more like 5.3 percent. Zillow, meanwhile, is exception-

on the market than there were at the end of 2020 because of how ally optimistic at 11.7 percent. Research firm Pulsenomics takes

16 GREEN BUILDER November/December 2021 www.greenbuildermedia.com