Page 19 - Green Builder Nov-Dec 2021 Issue

P. 19

THE STATE OF

SUSTAINABLE

BUILDING 2022

A Runaway Remodeling Market?

Rising home equity and pandemic-related free time led to homeowners investing in remodeling projects at a record

pace over the past two years. Homeowners spent an average of almost $18,000, up from a pre-COVID $12,000, 4 of 5 homeowners surveyed

and projects increased by 75 percent in some U.S. markets, according to COGNITION. There’s more to come: nearly said they plan to undertake at

4 out of 5 homeowners surveyed said they plan to undertake at least one new project within the next year, or have

already done so. least one new project within

Most of those projects are related to outdoor living (61 percent), interior upgrades like repainting, reflooring, and the next year

kitchen and bathroom renovations (58 percent), and tech improvements (44 percent), the survey notes.

Kitchens and bathrooms have long been two of the most frequently updated rooms in the home due to the “joy factor,”

or how much personal enjoyment homeowners get from creating dream spaces, COGNITION notes. They are also the Homeowners spent an

two most frequently used rooms in the house, so enhancing their aesthetics and functionality improves quality of life. average of almost $18,000,

Rising home prices also played a role in whether owners opened up their wallets, according to Houzz senior up from a pre-COVID $12,000

economist Marine Sargsyan. “While the pandemic caused initial concern for the residential renovation industry, many

homeowners finally had the time and financial means to move forward with long awaited projects in the past year,” on remodeling

Sargsyan notes. “This pent up demand, along with other long-standing market fundamentals such as accumulated

equity, will empower homeowners to continue investing in their current homes, rather than face skyrocketing prices

in the housing market.” Projects increased by 75

Nearly half of the respondents to Houzz’s own market survey said they had already planned, pre-pandemic, to percent in some U.S. markets

undertake a home improvement project. Another one-third cited financial means as being the key trigger. One-quarter

of respondents said they wanted to renovate because it was less expensive than buying a new home.

Remodeling can also often be done over time, which allows homeowners the ability to budget and stretch their How people prefer to

finances, COGNITION notes.

The generation most likely to remodel their homes are millennials, the current 20- and 30-somethings that made pay for remodeling:

up more than half of consumers surveyed by COGNITION. Generation X, which is only half the size of millennials, and Cash (83 percent)

baby boomers, most of whom are 60- or 70-plus and beginning to age out of the market, combine for about 30 percent.

Generation Z, the oldest of whom just reached the legal voting age, make up less than 10 percent of those with Credit cards (29 percent)

remodeling interest. But this group’s 67-million person size—only about 5 million less than the millennials—definitely Tax refunds (10 percent)

makes it the wave of the future, according to the Pew Research Center.

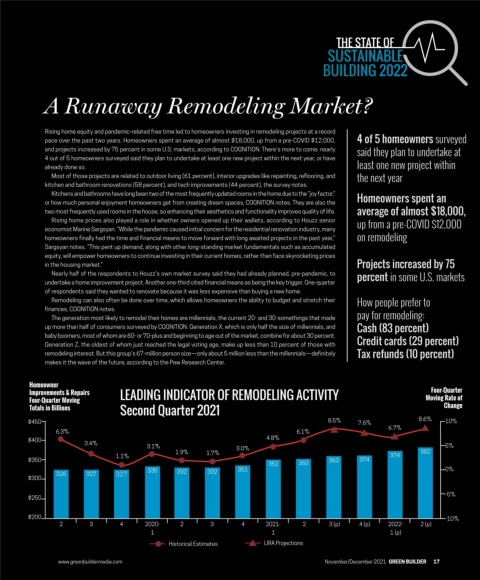

Homeowner

Improvements & Repairs LEADING INDICATOR OF REMODELING ACTIVITY Four-Quarter

Four-Quarter Moving Moving Rate of

Second Quarter 2021

Totals in Billions Change

$450 8.5% 7.6% 8.6% 10%

6.3% 6.1% 6.7%

$400 4.8%

3.4%

3.1% 3.0% 5%

1.9% 1.7% 382

1.1% 374

$350 363 374

352 360

335 332 332 351 0%

326 327 327

$300

-5%

$250

$200 -10%

2 3 4 2020- 2 3 4 2021- 2 3 (p) 4 (p) 2022- 2 (p)

1 1 1 (p)

Historical Estimates LIRA Projections

www.greenbuildermedia.com November/December 2021 GREEN BUILDER 17