Page 23 - Green Builder Nov-Dec 2021 Issue

P. 23

THE STATE OF

SUSTAINABLE

BUILDING 2022

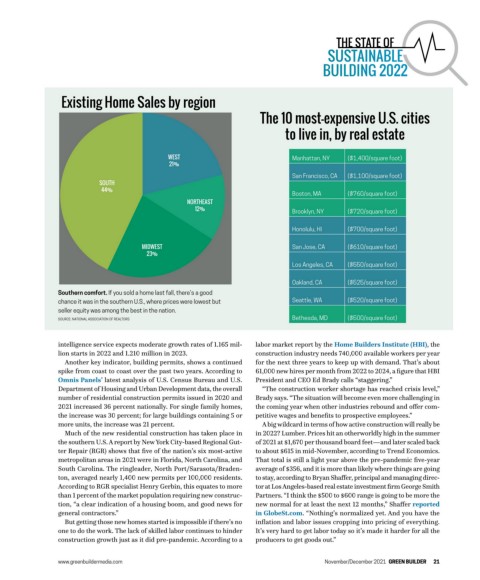

Existing Home Sales by region

The 10 most-expensive U.S. cities

to live in, by real estate

WEST Manhattan, NY ($1,400/square foot)

21%

San Francisco, CA ($1,100/square foot)

SOUTH

44%

Boston, MA ($760/square foot)

NORTHEAST

12% Brooklyn, NY ($720/square foot)

Honolulu, HI ($700/square foot)

MIDWEST San Jose, CA ($610/square foot)

23%

Los Angeles, CA ($550/square foot)

Oakland, CA ($525/square foot)

Southern comfort. If you sold a home last fall, there’s a good

chance it was in the southern U.S., where prices were lowest but Seattle, WA ($520/square foot)

seller equity was among the best in the nation.

SOURCE: NATIONAL ASSOCIATION OF REALTORS Bethesda, MD ($500/square foot)

intelligence service expects moderate growth rates of 1.165 mil- labor market report by the Home Builders Institute (HBI), the

lion starts in 2022 and 1.210 million in 2023. construction industry needs 740,000 available workers per year

Another key indicator, building permits, shows a continued for the next three years to keep up with demand. That’s about

spike from coast to coast over the past two years. According to 61,000 new hires per month from 2022 to 2024, a figure that HBI

Omnis Panels’ latest analysis of U.S. Census Bureau and U.S. President and CEO Ed Brady calls “staggering.”

Department of Housing and Urban Development data, the overall “The construction worker shortage has reached crisis level,”

number of residential construction permits issued in 2020 and Brady says. “The situation will become even more challenging in

2021 increased 36 percent nationally. For single family homes, the coming year when other industries rebound and offer com-

the increase was 30 percent; for large buildings containing 5 or petitive wages and benefits to prospective employees.”

more units, the increase was 21 percent. A big wildcard in terms of how active construction will really be

Much of the new residential construction has taken place in in 2022? Lumber. Prices hit an otherworldly high in the summer

the southern U.S. A report by New York City-based Regional Gut- of 2021 at $1,670 per thousand board feet—and later scaled back

ter Repair (RGR) shows that five of the nation’s six most-active to about $615 in mid-November, according to Trend Economics.

metropolitan areas in 2021 were in Florida, North Carolina, and That total is still a light year above the pre-pandemic five-year

South Carolina. The ringleader, North Port/Sarasota/Braden- average of $356, and it is more than likely where things are going

ton, averaged nearly 1,400 new permits per 100,000 residents. to stay, according to Bryan Shaffer, principal and managing direc-

According to RGR specialist Henry Gerbin, this equates to more tor at Los Angeles-based real estate investment firm George Smith

than 1 percent of the market population requiring new construc- Partners. “I think the $500 to $600 range is going to be more the

tion, “a clear indication of a housing boom, and good news for new normal for at least the next 12 months,” Shaffer reported

general contractors.” in GlobeSt.com. “Nothing’s normalized yet. And you have the

But getting those new homes started is impossible if there’s no inflation and labor issues cropping into pricing of everything.

one to do the work. The lack of skilled labor continues to hinder It’s very hard to get labor today so it’s made it harder for all the

construction growth just as it did pre-pandemic. According to a producers to get goods out.”

www.greenbuildermedia.com November/December 2021 GREEN BUILDER 21