Page 25 - Outstanding Women Friendly Physicians (2)

P. 25

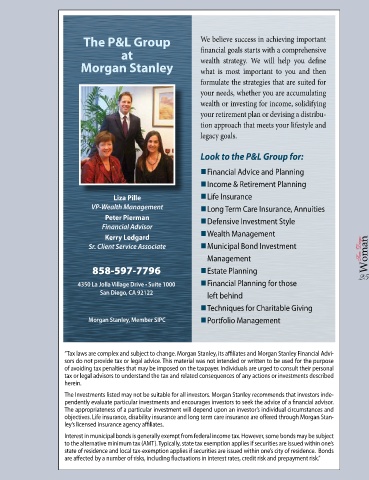

The P&L Group We believe success in achieving important

at financial goals starts with a comprehensive

wealth strategy. We will help you define

Morgan Stanley what is most important to you and then

formulate the strategies that are suited for

your needs, whether you are accumulating

wealth or investing for income, solidifying

your retirement plan or devising a distribu-

tion approach that meets your lifestyle and

legacy goals.

Look to the P&L Group for:

F

n inancial Advice and Planning

I

n ncome & Retirement Planning

Liza Pille n Life Insurance

VP-Wealth Management n ong Term Care Insurance, Annuities

L

Peter Pierman n efensive Investment Style

D

Financial Advisor

W

Kerry Ledgard n ealth Management

Sr. Client Service Associate n Municipal Bond Investment San Diego

Management Woman

858-597-7796 n Estate Planning 25

F

4350 La Jolla Village Drive • Suite 1000 n inancial Planning for those

San Diego, CA 92122 left behind

n echniques for Charitable Giving

T

Morgan Stanley, Member SIPC n ortfolio Management

P

“Tax laws are complex and subject to change. Morgan Stanley, its affiliates and Morgan Stanley Financial Advi-

sors do not provide tax or legal advice. This material was not intended or written to be used for the purpose

of avoiding tax penalties that may be imposed on the taxpayer. Individuals are urged to consult their personal

tax or legal advisors to understand the tax and related consequences of any actions or investments described

herein.

The Investments listed may not be suitable for all investors. Morgan Stanley recommends that investors inde-

pendently evaluate particular investments and encourages investors to seek the advice of a financial advisor.

The appropriateness of a particular investment will depend upon an investor’s individual circumstances and

objectives. Life insurance, disability insurance and long term care insurance are offered through Morgan Stan-

ley’s licensed insurance agency affiliates.

Interest in municipal bonds is generally exempt from federal income tax. However, some bonds may be subject

to the alternative minimum tax (AMT). Typically, state tax exemption applies if securities are issued within one’s

state of residence and local tax-exemption applies if securities are issued within one’s city of residence. Bonds

are affected by a number of risks, including fluctuations in interest rates, credit risk and prepayment risk.”