Page 24 - Woman 071319_interactive

P. 24

Low Mortgage Rates Will Boost Home Loan Applications Increasing

The most obvious sign that low mortgage rates are boost-

Summer Home Sales ing the housing market is that there has been a recent surge

Article Courtesy of Sparkling Marketing in home loan applications among buyers.

According to the statistics from the Mortgage Bankers

Association, home loan application volume surged during the

first week of June 2019. For the week ending June 7th, they

Mortgage rates in the USA are currently at a low, and it's increased 26.8 percent from one week earlier.

having a great impact on our housing markets. On June 13th The Mortgage Bankers Association survey covers approxi-

Freddie Mac reported that the average interest rate for a mately 75% of all mortgage applications for retail and residen-

30-year fixed mortgage was just 3.82%. That’s the lowest rate tial properties in the USA. It has been conducted every week

since September 2017. since 1990 and is considered a great place indicator of market

The low mortgage rates are already boosting home pur- health.

chases for summer 2019, and the trend is expected to con-

tinue. Low-interest rates are a strong incentive for buyers to

expedite their home purchase and secure the best mortgage

terms.

If a buyer uses a 30-year fixed mortgage to purchase a

home this summer, they could lock in a rate under 4% for the

length of the loan. This protects the buyer from future increas-

es in interest rates or market volatility down the road.

There are some buyers who want to wait to make a home

purchase because they believe the cost of homes will de-

crease over the next couple of years.

They are only half right.

While we are seeing some indications that home prices

could drop in 2020, it will not ultimately lead to lower costs for

the buyer. For most cities in California, home prices will remain

steady, and in a few cities, the home prices might drop three

to five percent. If a home that costs $500,000 now goes down

5% over the next two years, the new cost of the home will be

$475,000, and the buyer will save $25,000.

The problem is that rates could easily be a percent higher

than they are right now, and the overall cost to purchase the

home will have gone up significantly. In this case, just a 1%

increase will cost the buyer an extra $75,000 over the life of Mortgage Trends to Expect This Summer

the loan.

What are the mortgage trends we can expect in the sum-

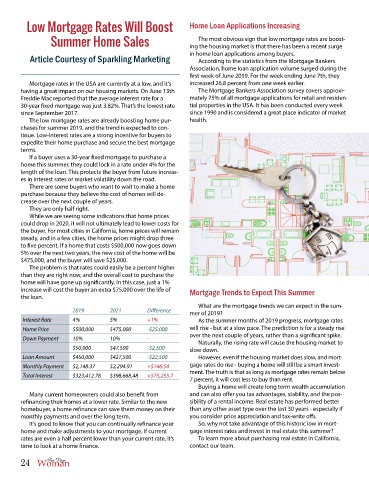

2019 2021 Difference

mer of 2019?

Interest Rate 4% 5% +1% As the summer months of 2019 progress, mortgage rates

Home Price $500,000 $475,000 -$25,000 will rise - but at a slow pace. The prediction is for a steady rise

over the next couple of years, rather than a significant spike.

Down Payment 10% 10% -

Naturally, the rising rate will cause the housing market to

$50,000 $47,500 -$2,500 slow down.

Loan Amount $450,000 $427,500 -$22,500 However, even if the housing market does slow, and mort-

Monthly Payment $2,148.37 $2,294.91 +$146.54 gage rates do rise - buying a home will still be a smart invest-

ment. The truth is that as long as mortgage rates remain below

Total Interest $323,412.78 $398,668.48 +$75,255.7

7 percent, it will cost less to buy than rent.

Buying a home will create long term wealth accumulation

Many current homeowners could also benefit from and can also offer you tax advantages, stability, and the pos-

refinancing their homes at a lower rate. Similar to the new sibility of a rental income. Real estate has performed better

homebuyer, a home refinance can save them money on their than any other asset type over the last 30 years - especially if

monthly payments and over the long term. you consider price appreciation and tax-write offs.

It’s good to know that you can continually refinance your So, why not take advantage of this historic low in mort-

home and make adjustments to your mortgage. If current gage interest rates and invest in real estate this summer?

rates are even a half percent lower than your current rate, it’s To learn more about purchasing real estate in California,

time to look at a home finance. contact our team.

24