Page 99 - BFSI CHRONICLE 10 th Issue (2nd Annual Issue ) .indd

P. 99

BFSI Chronicle, 2 Annual Issue, 10 Edition July 2022

nd

th

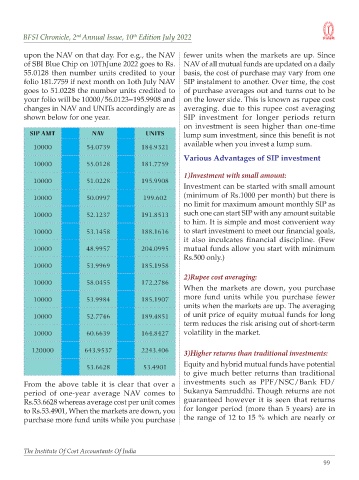

upon the NAV on that day. For e.g., the NAV fewer units when the markets are up. Since

of SBI Blue Chip on 10ThJune 2022 goes to Rs. NAV of all mutual funds are updated on a daily

55.0128 then number units credited to your basis, the cost of purchase may vary from one

folio 181.7759 if next month on 1oth July NAV SIP instalment to another. Over time, the cost

goes to 51.0228 the number units credited to of purchase averages out and turns out to be

your folio will be 10000/56.0123=195.9908 and on the lower side. This is known as rupee cost

changes in NAV and UNITs accordingly are as averaging. due to this rupee cost averaging

shown below for one year. SIP investment for longer periods return

on investment is seen higher than one-time

SIP AMT NAV UNITS lump sum investment, since this benefit is not

available when you invest a lump sum.

10000 54.0739 184.9321

Various Advantages of SIP investment

10000 55.0128 181.7759

1)Investment with small amount:

10000 51.0228 195.9908

Investment can be started with small amount

(minimum of Rs.1000 per month) but there is

10000 50.0997 199.602

no limit for maximum amount monthly SIP as

10000 52.1237 191.8513 such one can start SIP with any amount suitable

to him. It is simple and most convenient way

10000 53.1458 188.1616 to start investment to meet our financial goals,

it also inculcates financial discipline. (Few

10000 48.9957 204.0995 mutual funds allow you start with minimum

Rs.500 only.)

10000 53.9969 185.1958

2)Rupee cost averaging:

10000 58.0455 172.2786

When the markets are down, you purchase

more fund units while you purchase fewer

10000 53.9984 185.1907

units when the markets are up. The averaging

10000 52.7746 189.4851 of unit price of equity mutual funds for long

term reduces the risk arising out of short-term

10000 60.6639 164.8427 volatility in the market.

120000 643.9537 2243.406

3)Higher returns than traditional investments:

Equity and hybrid mutual funds have potential

53.6628 53.4901

to give much better returns than traditional

From the above table it is clear that over a investments such as PPF/NSC/Bank FD/

period of one-year average NAV comes to Sukanya Samruddhi. Though returns are not

Rs.53.6628 whereas average cost per unit comes guaranteed however it is seen that returns

to Rs.53.4901, When the markets are down, you for longer period (more than 5 years) are in

purchase more fund units while you purchase the range of 12 to 15 % which are nearly or

The Institute Of Cost Accountants Of India

99