Page 20 - MAYBANK vs EPF

P. 20

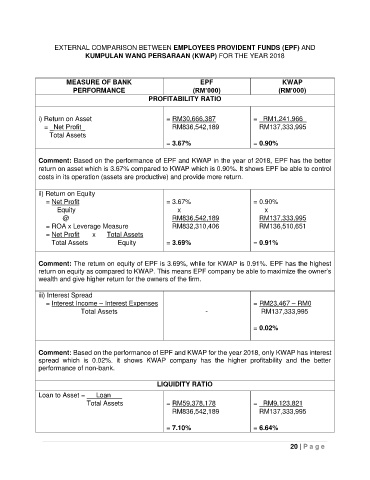

EXTERNAL COMPARISON BETWEEN EMPLOYEES PROVIDENT FUNDS (EPF) AND

KUMPULAN WANG PERSARAAN (KWAP) FOR THE YEAR 2018

MEASURE OF BANK EPF KWAP

PERFORMANCE (RM’000) (RM’000)

PROFITABILITY RATIO

i) Return on Asset = RM30,666,387 = RM1,241,966_

= _Net Profit_ RM836,542,189 RM137,333,995

Total Assets

= 3.67% = 0.90%

Comment: Based on the performance of EPF and KWAP in the year of 2018, EPF has the better

return on asset which is 3.67% compared to KWAP which is 0.90%. It shows EPF be able to control

costs in its operation (assets are productive) and provide more return.

ii) Return on Equity

= Net Profit = 3.67% = 0.90%

Equity x x

@ RM836,542,189 RM137,333,995

= ROA x Leverage Measure RM832,310,406 RM136,510,651

= Net Profit x Total Assets

Total Assets Equity = 3.69% = 0.91%

Comment: The return on equity of EPF is 3.69%, while for KWAP is 0.91%. EPF has the highest

return on equity as compared to KWAP. This means EPF company be able to maximize the owner’s

wealth and give higher return for the owners of the firm.

iii) Interest Spread

= Interest Income – Interest Expenses = RM23,467 – RM0

Total Assets - RM137,333,995

= 0.02%

Comment: Based on the performance of EPF and KWAP for the year 2018, only KWAP has interest

spread which is 0.02%. it shows KWAP company has the higher profitability and the better

performance of non-bank.

LIQUIDITY RATIO

Loan to Asset = Loan___

Total Assets = RM59,378,178 = RM9,123,821

RM836,542,189 RM137,333,995

= 7.10% = 6.64%

20 | P a g e