Page 18 - MAYBANK vs EPF

P. 18

= RM230,366,792 = 64.96%

RM456,613,298

= 50.45%

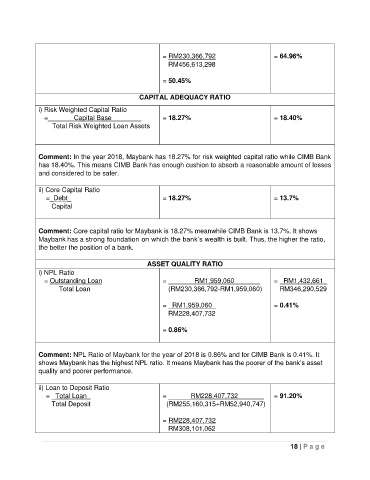

CAPITAL ADEQUACY RATIO

i) Risk Weighted Capital Ratio

=_______Capital Base________ = 18.27% = 18.40%

Total Risk Weighted Loan Assets

Comment: In the year 2018, Maybank has 18.27% for risk weighted capital ratio while CIMB Bank

has 18.40%. This means CIMB Bank has enough cushion to absorb a reasonable amount of losses

and considered to be safer.

ii) Core Capital Ratio

=_Debt_ = 18.27% = 13.7%

Capital

Comment: Core capital ratio for Maybank is 18.27% meanwhile CIMB Bank is 13.7%. It shows

Maybank has a strong foundation on which the bank’s wealth is built. Thus, the higher the ratio,

the better the position of a bank.

ASSET QUALITY RATIO

i) NPL Ratio

= Outstanding Loan = _______RM1,959,060_______ = RM1,432,661_

Total Loan (RM230,366,792-RM1,959,060) RM346,290,529

= _RM1,959,060_ = 0.41%

RM228,407,732

= 0.86%

Comment: NPL Ratio of Maybank for the year of 2018 is 0.86% and for CIMB Bank is 0.41%. It

shows Maybank has the highest NPL ratio. It means Maybank has the poorer of the bank’s asset

quality and poorer performance.

ii) Loan to Deposit Ratio

= _Total Loan_ = ______RM228,407,732_______ = 91.20%

Total Deposit (RM255,160,315+RM52,940,747)

= RM228,407,732

RM308,101,062

18 | P a g e