Page 13 - MAYBANK vs EPF

P. 13

Comment: Liquidity ratio of 2016 is 9.51% while for the year of 2017 is 8.77% and for the year 2018 is 7.10%.

It shows in the year of 2018 has the highest ratio as compared to 2016 and 2017. The higher the loan to total

assets, the lower the liquidity, the higher the credit risk.

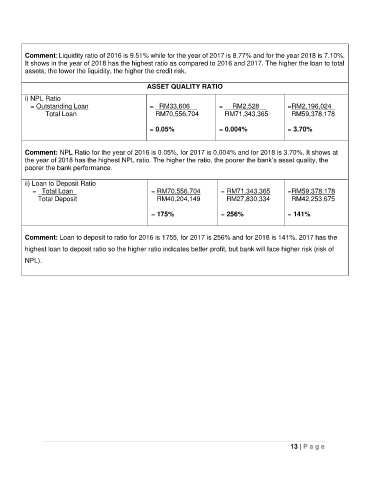

ASSET QUALITY RATIO

i) NPL Ratio

= Outstanding Loan = _RM33,606__ = __RM2,528__ =RM2,196,024_

Total Loan RM70,556,704 RM71,343,365 RM59,378,178

= 0.05% = 0.004% = 3.70%

Comment: NPL Ratio for the year of 2016 is 0.05%, for 2017 is 0.004% and for 2018 is 3.70%. It shows at

the year of 2018 has the highest NPL ratio. The higher the ratio, the poorer the bank’s asset quality, the

poorer the bank performance.

ii) Loan to Deposit Ratio

= _Total Loan_ = RM70,556,704 = RM71,343,365 =RM59,378,178

Total Deposit RM40,204,149 RM27,830,334 RM42,253,675

= 175% = 256% = 141%

Comment: Loan to deposit to ratio for 2016 is 1755, for 2017 is 256% and for 2018 is 141%. 2017 has the

highest loan to deposit ratio so the higher ratio indicates better profit, but bank will face higher risk (risk of

NPL).

13 | P a g e