Page 10 - MAYBANK vs EPF

P. 10

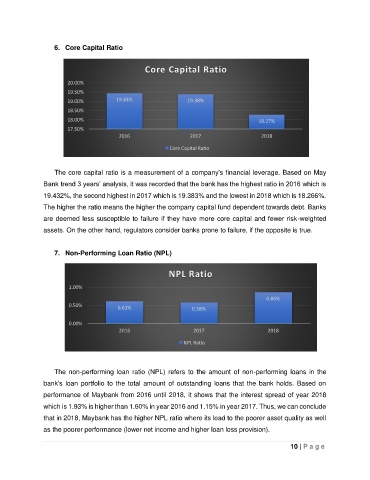

6. Core Capital Ratio

Core Capital Ratio

20.00%

19.50%

19.00% 19.43% 19.38%

18.50%

18.00% 18.27%

17.50%

2016 2017 2018

Core Capital Ratio

The core capital ratio is a measurement of a company's financial leverage. Based on May

Bank trend 3 years’ analysis, it was recorded that the bank has the highest ratio in 2016 which is

19.432%, the second highest in 2017 which is 19.383% and the lowest in 2018 which is 18.266%.

The higher the ratio means the higher the company capital fund dependent towards debt. Banks

are deemed less susceptible to failure if they have more core capital and fewer risk-weighted

assets. On the other hand, regulators consider banks prone to failure, if the opposite is true.

7. Non-Performing Loan Ratio (NPL)

NPL Ratio

1.00%

0.86%

0.50% 0.61% 0.58%

0.00%

2016 2017 2018

NPL Ratio

The non-performing loan ratio (NPL) refers to the amount of non-performing loans in the

bank's loan portfolio to the total amount of outstanding loans that the bank holds. Based on

performance of Maybank from 2016 until 2018, it shows that the interest spread of year 2018

which is 1.93% is higher than 1.60% in year 2016 and 1.15% in year 2017. Thus, we can conclude

that in 2018, Maybank has the higher NPL ratio where its lead to the poorer asset quality as well

as the poorer performance (lower net income and higher loan loss provision).

10 | P a g e