Page 7 - MAYBANK vs EPF

P. 7

COMMENT AND SUGGESTION ON HOW TO IMPROVE MAYBANK’S PERFORMANCE

1. Return on Asset

Return on Asset

2.00%

1.50%

1.60%

1.00% 1.36%

1.20%

0.50%

0.00%

2016 2017 2018

Return on Asset

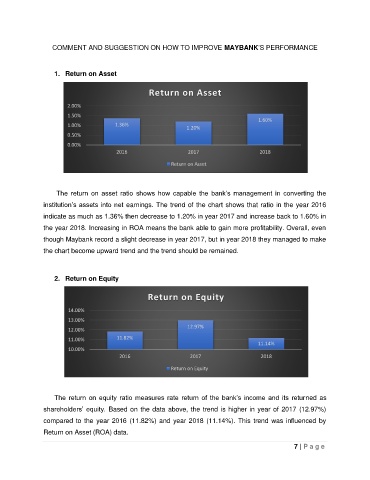

The return on asset ratio shows how capable the bank’s management in converting the

institution’s assets into net earnings. The trend of the chart shows that ratio in the year 2016

indicate as much as 1.36% then decrease to 1.20% in year 2017 and increase back to 1.60% in

the year 2018. Increasing in ROA means the bank able to gain more profitability. Overall, even

though Maybank record a slight decrease in year 2017, but in year 2018 they managed to make

the chart become upward trend and the trend should be remained.

2. Return on Equity

Return on Equity

14.00%

13.00%

12.97%

12.00%

11.00% 11.82%

11.14%

10.00%

2016 2017 2018

Return on Equity

The return on equity ratio measures rate return of the bank’s income and its returned as

shareholders’ equity. Based on the data above, the trend is higher in year of 2017 (12.97%)

compared to the year 2016 (11.82%) and year 2018 (11.14%). This trend was influenced by

Return on Asset (ROA) data.

7 | P a g e