Page 5 - MAYBANK vs EPF

P. 5

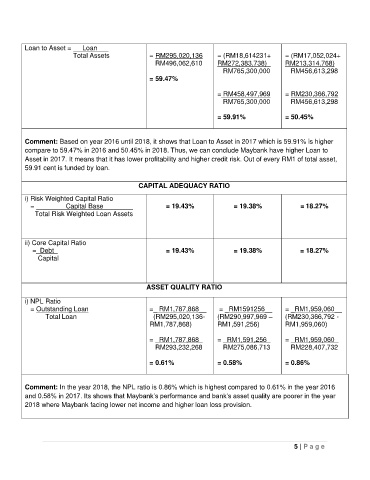

Loan to Asset = Loan___

Total Assets = RM295,020,136 = (RM18,614231+ = (RM17,052,024+

RM496,062,610 RM272,383,738)_ RM213,314,768)

RM765,300,000 RM456,613,298

= 59.47%

= RM458,497,969 = RM230,366,792

RM765,300,000 RM456,613,298

= 59.91% = 50.45%

Comment: Based on year 2016 until 2018, it shows that Loan to Asset in 2017 which is 59.91% is higher

compare to 59.47% in 2016 and 50.45% in 2018. Thus, we can conclude Maybank have higher Loan to

Asset in 2017. It means that it has lower profitability and higher credit risk. Out of every RM1 of total asset,

59.91 cent is funded by loan.

CAPITAL ADEQUACY RATIO

i) Risk Weighted Capital Ratio

= ________Capital Base________ = 19.43% = 19.38% = 18.27%

Total Risk Weighted Loan Assets

ii) Core Capital Ratio

=_Debt_ = 19.43% = 19.38% = 18.27%

Capital

ASSET QUALITY RATIO

i) NPL Ratio

= Outstanding Loan =_ RM1,787,868__ = _RM1591256__ = _RM1,959,060__

Total Loan (RM295,020,136- (RM290,997,969 – (RM230,366,792 -

RM1,787,868) RM1,591,256) RM1,959,060)

= _RM1,787,868_ = _RM1,591,256_ = _RM1,959,060_

RM293,232,268 RM275,086,713 RM228,407,732

= 0.61% = 0.58% = 0.86%

Comment: In the year 2018, the NPL ratio is 0.86% which is highest compared to 0.61% in the year 2016

and 0.58% in 2017. Its shows that Maybank’s performance and bank’s asset quality are poorer in the year

2018 where Maybank facing lower net income and higher loan loss provision.

5 | P a g e