Page 21 - MAYBANK vs EPF

P. 21

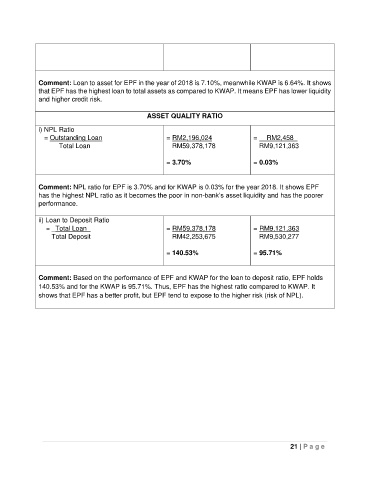

Comment: Loan to asset for EPF in the year of 2018 is 7.10%, meanwhile KWAP is 6.64%. It shows

that EPF has the highest loan to total assets as compared to KWAP. It means EPF has lower liquidity

and higher credit risk.

ASSET QUALITY RATIO

i) NPL Ratio

= Outstanding Loan = RM2,196,024 = RM2,458_

Total Loan RM59,378,178 RM9,121,363

= 3.70% = 0.03%

Comment: NPL ratio for EPF is 3.70% and for KWAP is 0.03% for the year 2018. It shows EPF

has the highest NPL ratio as it becomes the poor in non-bank’s asset liquidity and has the poorer

performance.

ii) Loan to Deposit Ratio

= _Total Loan_ = RM59,378,178 = RM9,121,363

Total Deposit RM42,253,675 RM9,530,277

= 140.53% = 95.71%

Comment: Based on the performance of EPF and KWAP for the loan to deposit ratio, EPF holds

140.53% and for the KWAP is 95.71%. Thus, EPF has the highest ratio compared to KWAP. It

shows that EPF has a better profit, but EPF tend to expose to the higher risk (risk of NPL).

21 | P a g e