Page 322 - Corporate Finance PDF Final new link

P. 322

NPP

322 Corporate Finance BRILLIANT’S

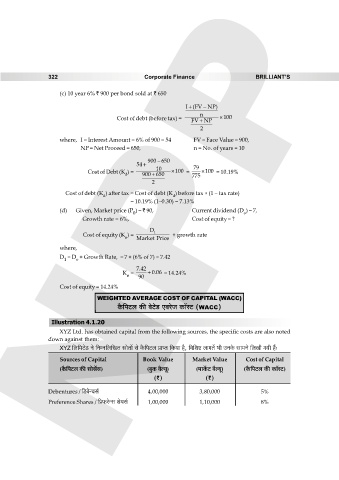

(c) 10 year 6% ` 900 per bond sold at ` 650

I (FV NP)

n

Cost of debt (before tax) = FV NP 100

2

where, I = Interest Amount = 6% of 900 = 54 FV = Face Value = 900,

NP = Net Proceed = 650, n = No. of years = 10

900 650

54

10 79

Cost of Debt (K ) = 100 = 100 = 10.19%

d 900 650 775

2

Cost of debt (K ) after tax = Cost of debt (K ) before tax × (1 – tax rate)

d d

= 10.19% (1–0.30) = 7.13%

(d) Given, Market price (P ) = ` 90, Current dividend (D ) = 7,

0 o

Growth rate = 6%, Cost of equity = ?

D 1

Cost of equity (K ) = + growth rate

e Market Price

where,

D = D + Growth Rate, = 7 + (6% of 7) = 7.42

1 o

7.42

K = 0.06 = 14.24%

e 90

Cost of equity = 14.24%

WEIGHTED AVERAGE COST OF CAPITAL (WACC)

H¡${nQ>b H$s doQ>oS> EdaoO H$m°ñQ> (WACC)

Illustration 4.1.20

XYZ Ltd. has obtained capital from the following sources, the specific costs are also noted

down against them:

XYZ {b{‘Q>oS> Zo {ZåZ{b{IV òmoVm| go H¡${nQ>b àmßV {H$¶m h¡, {d{eï> bmJV| ^r CZHo$ gm‘Zo {bIr J¶r h¢…

Sources of Capital Book Value Market Value Cost of Capital

(H¡${nQ>b H$s gmog}g) (~wH$ d¡ë¶y) (‘mH}$Q> d¡ë¶y) (H¡${nQ>b H$s H$m°ñQ>)

(`) (`)

Debentures / {S>~oÝMg© 4,00,000 3,80,000 5%

Preference Shares / {à’$aoÝg eo¶g© 1,00,000 1,10,000 8%