Page 327 - Corporate Finance PDF Final new link

P. 327

BRILLIANT’S Cost of Capital 327

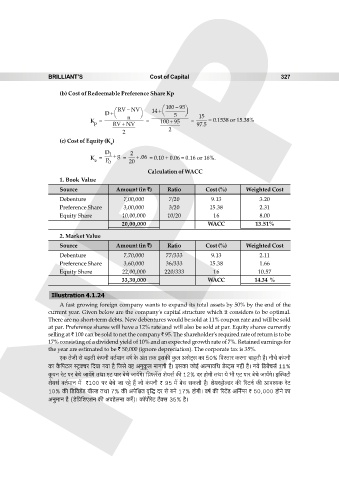

(b) Cost of Redeemable Preference Share Kp

RV NV 14 100 95

D 5

n 15

K = = 100 95 = 0.1538 or 15.38%

p RV NV 97.5

2

2

(c) Cost of Equity (K )

e

D 1 2

K = g = .06 = 0.10 + 0.06 = 0.16 or 16%.

e P 0 20

Calculation of WACC

1. Book Value

Source Amount (in `) Ratio Cost (%) Weighted Cost

Debenture 7,00,000 7/20 9.13 3.20

Preference Share 3,00,000 3/20 15.38 2.31

10,00,000

Equity Share NPP 10/20 16 8.00

20,00,000 WACC 13.51%

2. Market Value

Source Amount (in `) Ratio Cost (%) Weighted Cost

Debenture 7,70,000 77/333 9.13 2.11

Preference Share 3,60,000 36/333 15.38 1.66

Equity Share 22,00,000 220/333 16 10.57

33,30,000 WACC 14.34 %

Illustration 4.1.24

A fast growing foreign company wants to expand its total assets by 50% by the end of the

current year. Given below are the company's capital structure which it considers to be optimal.

There are no short-term debts. New debentures would be sold at 11% coupon rate and will be sold

at par. Preference shares will have a 12% rate and will also be sold at par. Equity shares currently

selling at ` 100 can be sold to net the company ` 95. The shareholder's required rate of return is to be

17% consisting of a dividend yield of 10% and an expected growth rate of 7%. Retained earnings for

the year are estimated to be ` 50,000 (ignore depreciation). The corporate tax is 35%.

EH$ VoOr go ~‹T>Vr H§$nZr dV©‘mZ df© Ho$ A§V VH$ BgH$s Hw$b AgoQ²>g H$m 50% {dñVma H$aZm MmhVr h¡& ZrMo H$§nZr

H$m H¡${nQ>b ñQ´>³Ma {X¶m J¶m h¡ {Ogo dh AZwHy$b ‘mZVr h¡& BgH$m H$moB© Aënmd{Y S>oãQ²>g Zht h¡& Z¶o {S>~|Mg© 11%

Hy$nZ aoQ> na ~oMo Om¶|Jo VWm EQ> nma ~oMo Om¶|Jo& {à’$a|g eo¶g© H$s 12% Xa hmoJr VWm ¶o ^r EQ> nma ~oMo Om¶|Jo& Bp³dQ>r

eo¶g© dV©‘mZ ‘| `100 na ~oMo Om aho h¢ Omo H§$nZr ` 95 ‘| ~oM gH$Vr h¡& eo¶ahmoëS>a H$s [aQ>Z© H$s Amdí¶H$ aoQ>

10% H$s {S>{dS>|S> ¶rëS> VWm 7% H$s Ano{jV d¥{Õ Xa go ~Zo 17% hmoJr& df© H$s [aQ>|S> A{Zª½g ` 50,000 hmoZo H$m

AZw‘mZ h¡ (S>o{à{eEeZ H$s AdhobZm H$a|)& H$m°nm}aoQ> Q>¡³g 35% h¡&