Page 325 - Corporate Finance PDF Final new link

P. 325

NPP

BRILLIANT’S Cost of Capital 325

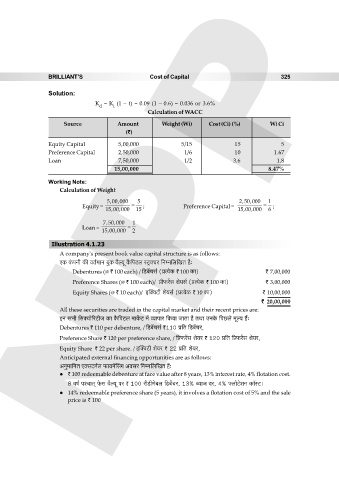

Solution:

K = K (1 – t) = 0.09 (1 – 0.6) = 0.036 or 3.6%

d i

Calculation of WACC

Source Amount Weight (Wi) Cost (Ci) (%) Wi Ci

(`)

Equity Capital 5,00,000 5/15 15 5

Preference Capital 2,50,000 1/6 10 1.67

Loan 7,50,000 1/2 3.6 1.8

15,00,000 8.47%

Working Note:

Calculation of Weight

5,00,000 5 2,50,000 1

Equity = ; Preference Capital = ;

15,00,000 15 15,00,000 6

7,50,000 1

Loan =

15,00,000 2

Illustration 4.1.23

A company's present book value capital structure is as follows:

EH$ H§$nZr H$s dV©‘mZ ~wH$ d¡ë¶y H¡${nQ>b ñQ´>³Ma {ZåZ{b{IV h¡…

Debentures (@ ` 100 each) / {S>~|Mg© (à˶oH$ ` 100 H$m) ` 7,00,000

Preference Shares (@ ` 100 each)/ àr’$a|g eo¶g© (à˶oH$ ` 100 H$m) ` 3,00,000

Equity Shares (@ ` 10 each)/ Bp³dQ>r eo¶g© (à˶oH$ ` 10 H$m) ` 10,00,000

` 20,00,000

All these securities are traded in the capital market and their recent prices are:

BZ g^r {g³¶mo[aQ>rO H$m H¡${nQ>b ‘mH}$Q> ‘| ì¶mnma {H$¶m OmVm h¡ VWm CZHo$ {nN>bo ‘yë¶ h¢…

Debentures ` 110 per debenture, / {S>~|Mg© `110 à{V {S>~|Ma,

Preference Share ` 120 per preference share, / {à’$a|g eo¶a ` 120 à{V {à’$a|g eo¶a,

Equity Share ` 22 per share. / Bp³dQ>r eo¶a ` 22 à{V eo¶a,

Anticipated external financing opportunities are as follows:

AZw‘m{ZV E³gQ>Z©b ’$m¶Z|qgJ Adga {ZåZ{b{IV h¢…

` 100 redeemable debenture at face value after 8 years, 13% interest rate, 4% flotation cost.

8 df© níMmV² ’o$g d¡ë¶y na ` 100 arS>r‘o~b {S>~|Ma, 13% ã¶mO Xa, 4% âbmoQ>oeZ H$m°ñQ>&

14% redeemable preference share (5 years), it involves a flotation cost of 5% and the sale

price is ` 100