Page 371 - Corporate Finance PDF Final new link

P. 371

NPP

BRILLIANT’S Capital Structure Theories 371

Expected yield per year

Present value of proposal =

Return required (cost of investment)

Expected yield per year

40,000 =

0.152

Annual yield = 40,000 × 0.152 = ` 6,080.

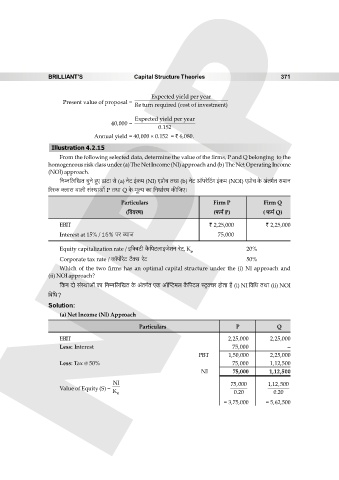

Illustration 4.2.15

From the following selected data, determine the value of the firms, P and Q belonging to the

homogeneous risk class under (a) The Net Income (NI) approach and (b) The Net Operating Income

(NOI) approach.

{ZåZ{b{IV MwZo hþE S>mQ>m go (a) ZoQ> B§H$‘ (NI) EàmoM VWm (b) ZoQ> Am°naoqQ>J B§H$‘ (NOI) EàmoM Ho$ A§VJ©V g‘mZ

[añH$ ³bmg dmbr g§ñWmAm| P VWm Q Ho$ ‘yë¶ H$m {ZYm©aU H$s{OE&

Particulars Firm P Firm Q

({ddaU) (’$‘© P) ( ’$‘© Q)

EBIT ` 2,25,000 ` 2,25,000

Interest at 15% / 15% na ã¶mO 75,000

Equity capitalization rate / B[³dQ>r H¡${nQ>bmBOoeZ aoQ>, K 20%

e

Corporate tax rate / H$m°nm}aoQ> Q>¡³g aoQ> 50%

Which of the two firms has an optimal capital structure under the (i) NI approach and

(ii) NOI approach?

{H$Z Xmo g§ñWmAm| H$m {ZåZ{b{IV Ho$ A§VJ©V EH$ Am°pßQ>‘b H¡${nQ>b ñQ´>³Ma hmoVm h¡ (i) NI {d{Y VWm (ii) NOI

{d{Y?

Solution:

(a) Net Income (NI) Approach

Particulars P Q

EBIT 2,25,000 2,25,000

Less: Interest 75,000 –

PBT 1,50,000 2,25,000

Less: Tax @ 50% 75,000 1,12,500

NI 75,000 1,12,500

NI 75,000 1,12,500

Value of Equity (S) =

K e 0.20 0.20

= 3,75,000 = 5,62,500