Page 367 - Corporate Finance PDF Final new link

P. 367

NPP

BRILLIANT’S Capital Structure Theories 367

Rate / aoQ> 10% Nil

Equity Capitalization Rate / B{³dQ>r H¡${nQ>bmBOoeZ aoQ> 15%

Corporate Tax Rate / H$m°nm}aoQ> Q>¡³g aoQ> 35%

Solution:

Value of Company A (it is levered) = Value of Unlevered Company + Bt

EBIT(1 t) 1,50,000(1 0.35)

Value of Company B (unlevered) = = = ` 6,50,000

K 0.15

e

Value of Company A = (6,50,000 + 4,00,000) × 0.35

= 6,50,000 + 1,40,000 = ` 7,90,000

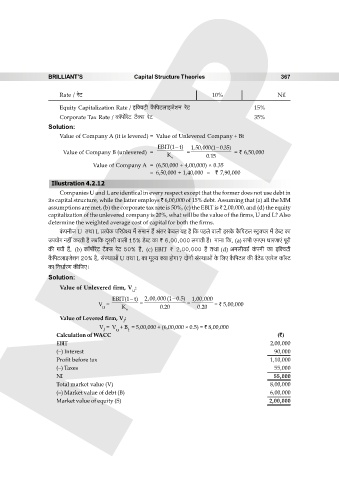

Illustration 4.2.12

Companies U and L are identical in every respect except that the former does not use debt in

its capital structure, while the latter employs ` 6,00,000 of 15% debt. Assuming that (a) all the MM

assumptions are met, (b) the corporate tax rate is 50%, (c) the EBIT is ` 2,00,000, and (d) the equity

capitalization of the unlevered company is 20%, what will be the value of the firms, U and L? Also

determine the weighted average cost of capital for both the firms.

H§$nZrO U VWm L à˶oH$ n[aàoú¶ ‘| g‘mZ h¢ A§Va Ho$db ¶h h¡ {H$ nhbo dmbr BgHo$ H¡${nQ>b ñQ´>³Ma ‘| S>oãQ> H$m

Cn¶moJ Zht H$aVr h¡ O~{H$ Xÿgar dmbr 15% S>oãQ> H$m < 6,00,000 bJmVr h¡& ‘mZm {H$, (a) g^r E‘E‘ YmaUmE§ nyar

H$s J¶r h¢, (b) H$m°nm}aoQ> Q>¡³g aoQ> 50% h¡, (c) EBIT < 2,00,000 h¡ VWm (d) AZbrdS>© H§$nZr H$m B{³dQ>r

H¡${nQ>bmBOoeZ 20% h¡, g§ñWmAm| U VWm L H$m ‘yë¶ ³¶m hmoJm? XmoZm| g§ñWmAm| Ho$ {bE H¡${nQ>b H$s d¡Q>oS> EdaoO H$m°ñQ>

H$m {ZYm©aU H$s{OE&

Solution:

Value of Unlevered firm, V :

u

EBIT(1 t) 2,00,000 (1 0.5) 1,00,000

V = = ` 5,00,000

u K e 0.20 0.20

Value of Levered firm, V :

l

V = V + B = 5,00,000 + (6,00,000 × 0.5) = ` 8,00,000

l u t

Calculation of WACC (`)

EBIT 2,00,000

(–) Interest 90,000

Profit before tax 1,10,000

(–) Taxes 55,000

NI 55,000

Total market value (V) 8,00,000

(–) Market value of debt (B) 6,00,000

Market value of equity (S) 2,00,000