Page 7 - Winsight 2021 Benefit Guide

P. 7

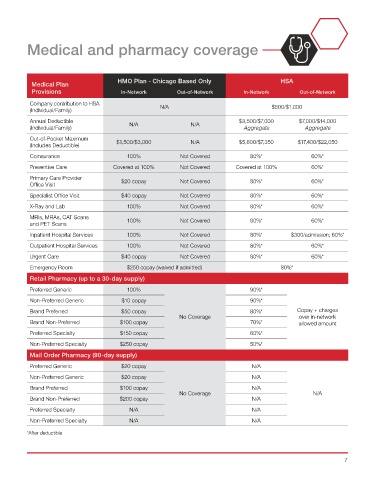

Medical and pharmacy coverage

HMO Plan - Chicago Based Only HSA

Medical Plan

Provisions In-Network Out-of-Network In-Network Out-of-Network

Company contribution to HSA

(Individual/Family) N/A $500/$1,000

Annual Deductible $3,500/$7,000 $7,000/$14,000

(Individual/Family) N/A N/A Aggregate Aggregate

Out-of-Pocket Maximum

(Includes Deductible) $1,500/$3,000 N/A $5,800/$7,350 $17,400/$22,050

Coinsurance 100% Not Covered 80%* 60%*

Preventive Care Covered at 100% Not Covered Covered at 100% 60%*

Primary Care Provider

Office Visit $20 copay Not Covered 80%* 60%*

Specialist Office Visit $40 copay Not Covered 80%* 60%*

X-Ray and Lab 100% Not Covered 80%* 60%*

MRIs, MRAs, CAT Scans 100% Not Covered 80%* 60%*

and PET Scans

Inpatient Hospital Services 100% Not Covered 80%* $300/admission; 60%*

Outpatient Hospital Services 100% Not Covered 80%* 60%*

Urgent Care $40 copay Not Covered 80%* 60%*

Emergency Room $250 copay (waived if admitted) 80%*

Retail Pharmacy (up to a 30-day supply)

Preferred Generic 100% 90%*

Non-Preferred Generic $10 copay 90%*

Brand Preferred $50 copay 80%* Copay + charges

No Coverage over in-network

Brand Non-Preferred $100 copay 70%* allowed amount

Preferred Specialty $150 copay 60%*

Non-Preferred Specialty $250 copay 50%*

Mail Order Pharmacy (90-day supply)

Preferred Generic $20 copay N/A

Non-Preferred Generic $20 copay N/A

Brand Preferred $100 copay N/A

No Coverage N/A

Brand Non-Preferred $200 copay N/A

Preferred Specialty N/A N/A

Non-Preferred Specialty N/A N/A

*After deductible

7